Every trade has to be supported by an underlying Investment Thesis, or reason, why the big financial institutions would hold a company in its portfolio. That Investment Thesis provides the foundation on which a Fast Trade can be made when there is a dislocation between the stock price and the intrinsic value of the company.

CHOOSE THE RIGHT STOCK

When considering a Fast Trade in any company, the Trade Thesis has to supported by a strong Investment Thesis which should be considered within the context of three areas.

Best in Class – CVX is one of the largest major integrated oil companies in North America. For Fiscal 2022 they reported a profit of $36.5B, paid out $26B to investors through dividends and share buybacks and announced a further $75B share buyback program over 5 years.

Secular Growth Trend – is a change in the way society behaves. The strong movement by Governments to reduce fossil fuel consumption through environmental regulation and a movement towards electrification will work to slow the overall growth in oil consumption, However, the world runs on oil, societies infrastructure is founded on oil, and the oil/electrification transition is expected to take approximately 30 years.

Strong Macroeconomic Environment – As of February 2023 the US economy is strong, causing the US Federal Reserve to increase interest rates. Many analysts view the interest rate policy as a deliberate move to force the economy into a recession. Recessions historically cause oil prices to decline.

INVESTMENT THESIS

The Investment Thesis is founded on 3 pillars

- Dividend and Share Buyback program

- Oil Supply/Demand

- Institutional Ownership

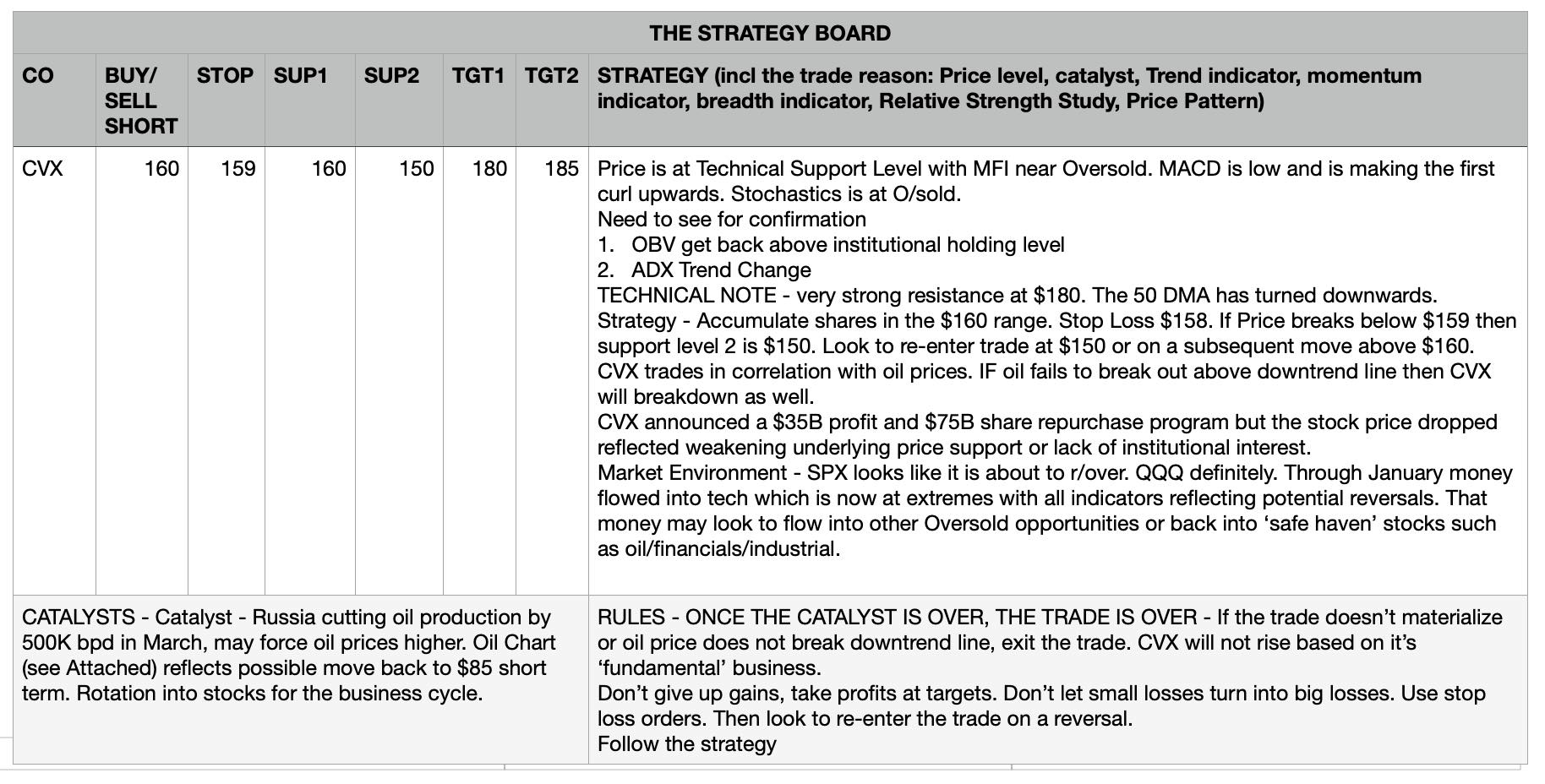

TRADE THESIS

The Trade Thesis is founded on three pillars

- Sector Rotation – Through January and February investors abandoned Oil related stocks as part of a broad market rotation into tech. As profits are taken in tech, money may flow into sectors and companies that have the highest risk/return ratio.

- Catalysts – Russia has announced that it will cut production by approximately 5%, or 500,000 barrels/day, in March. This will affect the supply side of the supply/demand dynamic. As the summer driving season approaches, gasoline use will increase. Re-opening of china’s economy will affect demand.

- Technical Analysis – reflects that the stock price is near an oversold condition.

RISKS TO THE TRADE

- OIL PRICES – SEE CHART OF WEST TEXAS INTERMEDIATE CRUDE BELOW – CVX stock price closely tracks oil. If price drops below $70 or does not climb above $80 then the trade will not materialize and should be exited.

- RECESSION – generally oil prices drop during a recession. If sentiment shifts towards increased possibility of recession, CVX’s stock price may be affected.

- DON’T FIGHT THE TREND – the current trend in oil stock prices is downward. Trading against the trend involves high risk. It is important to follow a strategy. Take profits at Targets and maintain STOP LOSS sell orders to minimize risk.

CHART TECHNICAL ANALYSIS

|

|

|