Earnings Season is a volatile period with Big Money Managers and Short Sellers positioning to capitalize on news releases. Good reports are rewarded and weak reports or lowered forward guidance will be sold. Monitoring company earnings reports will help understand the big moves and provide insight to whether the Investment or Trade Thesis is still valid.

NOTE: report dates and times are subject to change

SCHEDULE JULY 10 – 14

| MONDAY 10 | TUESDAY 11 | WEDNESDAY 12 | THURSDAY 13 | FRIDAY 14 |

| DELTA AIRLINES | JPMORGAN WELLS FARGO |

REPORTS

DELTA AIRLINES 13/07/2023

JPMORGAN

WELLS FARGO

SCHEDULE JULY 17 – 21

| MONDAY 17 | TUESDAY 18 | WEDNESDAY 19 | THURSDAY 20 | FRIDAY 20 |

| NETFLIX UNITED AIRLINES GOLDMAN SACHS TESLA | FREEPORT MCMORAN JNJ INTUITIVE SURGICAL GE HEALTHCARE |

SCHEDULE JULY 24 – 28

| MONDAY 24 | TUESDAY 25 | WEDNESDAY 26 | THURSDAY 27 | FRIDAY 28 |

| MICROSOFT VISA GENERAL ELECTRIC UNITED RENTALS 25-31 | US FEDERAL RESERVE INTEREST RATE ANNOUNCEMENT | AMZN 26-31 META BOEING | CHEVRON |

SCHEDULE JULY 31 – AUGUST 4

| MONDAY 31 | TUESDAY 1 | WEDNESDAY 2 | THURSDAY 3 | FRIDAY 4 |

| EXPEDIA 2 – 7 PHILLIPS 66 | APPLE |

APPLE EARNINGS REPORT

SCHEDULE AUGUST 7 – 11

| MONDAY 7 | TUESDAY 8 | WEDNESDAY 9 | THURSDAY 10 | FRIDAY 11 |

| DISNEY |

Disney Earnings Report

We listened to the Disney Earnings Conference call 9/8/2023.

Disney reported the following metrics

- EPS: $1.03 per share, adjusted, vs. 95 cents per share expected, according to a Refinitiv consensus survey

- Revenue: $22.33 billion vs. $22.5 billion expected, according to Refinitiv

- Disney+ total subscriptions: 146.1 million vs. 151.1 million expected, according to StreetAccount

Leading into the quarterly report there were a number of concerns which have been holding down the share price

- Disney+ Subscription numbers and the effect on revenue generation

- Parks attendance

- ESPN and traditional linear TV cord cutting

Additionally, Disney made three significant announcements

1. ESPN launches sportsbook in partnership with Penn Entertainment

2. Increase in subscription fee for non-ad tier supported subscribers.

3. Password sharing crackdown initiative

The following comments were important from the earnings call commentary

Parks attendance and Cruise Ships

“Current Q4 booked occupancy for our existing fleet of five ships is at 98%, and we will be expanding our fleet by adding two more ships in fiscal ’25 and another in fiscal ’26, nearly doubling our worldwide capacity.”

“Our Parks, Experiences, and Products portfolio of businesses continues to be an earnings and free cash flow growth driver for the company with both revenue and operating income increasing by more than 10% versus the prior year. International parks continued its strong growth trend with year-over-year operating income increasing at all our international sites, but most significantly at Shanghai Disney, which saw record highs from a revenue, OI, and margin perspective. At domestic Parks and Experiences, operating income was up 24% versus pre-pandemic results in fiscal ’19, but declined 13% versus the prior year. “

Disney+ subscription numbers and revenue generation

“The third area that will drive growth and value creation for Disney is our direct-to-consumer business… as of the end of Q3, we’ve signed up 3.3 million subscribers to our ad-supported Disney+ option… Since its inception, 40% of new Disney+ subscribers are choosing an ad-supported product… our ad-supported Disney+ subscription offerings will become available in Canada and in select markets across Europe, beginning November 1st, while a new ad-free bundled subscription plan featuring Disney+ and Hulu will be available in the U.S.”

“we do expect that in the fourth quarter, we will see core Disney+ net adds rebound with growth both domestically and internationally. Disney+ core ARPU increased sequentially by $0.11 driven by higher per-subscriber advertising revenue domestically as well as price increases in certain international markets. With over 40% of gross adds opting for the ad tier, the domestic Disney+ ad tier is continuing to improve our ARPU.”

“regarding password sharing, we are — we already have the technical capability to monitor much of this. And I’m not going to give you a specific number, except to say that it’s significant. What we don’t know, of course, is as we get to work on this, how much of the password sharing as we basically eliminate it will convert to growth in subs.”

“ in calendar ’24, we’re going to get at this issue. And so while it is likely you’ll see some impact in calendar ’24, it’s possible that we won’t be complete or the work will not be completed within the calendar year. But we certainly have established this as a real priority. And we actually think that there’s an opportunity here to help us grow our business.”

ESPN

“Taking our ESPN flagship channels direct-to-consumer is not a matter of if but when. And the team is hard at work looking at all components of this decision, including pricing and timing. It’s interesting to note that ratings continue to increase on ESPN’s main linear channel even as cord-cutting has accelerated.”

“Yesterday, it was announced that ESPN has entered into an exclusive licensing arrangement with PENN Entertainment to further extend the ESPN brand into the growing sports betting marketplace… Overall, we’re considering potential strategic partnerships for ESPN, looking at distribution, technology, marketing, and content opportunities where we retain control of ESPN.”

“On ESPN Bet, you say why now? Well, we’ve been in discussions with a number of entities over a fairly long period of time. It’s something that we’ve wanted to accomplish, obviously, because we believe there’s an opportunity here to significantly grow engagement with ESPN consumers, particularly young consumers.”

What does that mean at stockmarketHQ

Parks attendance and cruise ships are consistent and remain a foundation for the Disney business structure. Disney had previously announced a $5B cost reduction plan across parks and content creation and Disney is executing on this.

What is interesting is that 6 months ago, ‘cost reduction’ was the buzzword that wall Street wanted to hear and which drove companies shares upwards. For example, Meta Platforms announced it’s ‘Year of Efficiency’ program which drove shares nearly 100% in three months.

By Contrast, Disney is the worst performing stock in the Dow Jones Index.

Streaming subscribers for any provider have always been inconsistent. Netflix for years has been a Yo-Yo in stock price as subscriber numbers either exceed or fall short of analyst estimates.

In contrast to Netflix, it’s necessary to consider the Disney business as a whole, not just the metric of subscriber numbers.

What is important is that Disney specifically acknowledges that ‘cord cutting has accelerated’ and they are taking the following initiatives to rebalance the revenue generation.

- Increasing ‘subscription’ pricing and an add supported network with over 40% of new Disney+ subscribers choose add-supported. All media platforms, whether facebook, google, amazon, or netflix are actually advertising platforms and advertising draws a higher ‘Average Revenue Per User’ (ARPU) than a direct subscription. By increasing subscription pricing, the strategy seems to be to drive subscribers towards the advertising platform. This is a strategy that netflix has also taken and resulted in a share price increase from $300 up to $430.

- Password sharing crackdown is an initiative that Netflix has also undertaken. This also has the effect of driving non paying viewers either towards a paid subscription or towards the lower cost but higher profit add supported option. However, Disney specifically stated that this initiative may take through 2024 to complete.

The monetization of ESPN is going to continue to be important as the linearTV to streaming transition unfolds. ESPN is a strong brand with dominant sporting partnerships. From the Earnings conference call, Disney does not have a plan established for this, but they acknowledge that it has to happen and are working on it. ESPN Bet is one monetization initiative.

When a company stock price declines into the earnings report there is usually one of two reactions.

- The stock price declines further as the report is ‘worse than feared’ or

- The stock price recovers to a price that reflects the company value if the report is ‘not as bad as feared’.

This report would be classified as ‘Not as Bad as Feared’. The issues, and the companies plans and strategies to address them are going to take another three to 6 months.

With the stock price at the same level as the lows of the Covid pandemic, where the entire company operations was shut down, Disney’s stock price is currently undervalued. At what point Wall Street recognizes that and Big Money Managers start to accumulate shares, remains unknown. But once they do, the price may move up quickly to a ‘fair value’.

Nvidia Earnings Report

Nvidia reported the following quarterly earnings metrics on August 23, 2023.

Revenue $13.51 billion, up 101% from a year ago and up 88% over June quarter

- Data Center revenue was a record $10.3B, up 171% from a year ago and up 141% sequentially,

- Gaming revenue was $2.48B up 22% from a year ago and up 11% sequentially

- Professional Visualization revenue was $379M down 24% from a year ago and up 28% sequentially

- Automotive revenue was $253M up 15% from a year ago and down 15% sequentially

- Gross margins expanded to 70.1% and non-GAAP gross margin to 71.2% driven by higher data center sales.

- $3.4 billion returned to shareholders in the form of share repurchases and cash dividends. Additional $25 billion in stock repurchases to add to the remaining 4 billion of authorization as of the end of Q2.

Next quarter outlook

Outlook for the third quarter of fiscal 2024 is as follows:

- Revenue is expected to be $16.00 billion, plus or minus 2%.

- GAAP and non-GAAP gross margins are expected to be 71.5% and 72.5%, respectively, plus or minus 50 basis points.

- GAAP and non-GAAP operating expenses are expected to be approximately $2.95 billion and $2.00 billion, respectively.

- GAAP and non-GAAP other income and expense are expected to be an income of approximately $100 million, excluding gains and losses from non-affiliated investments.

- GAAP and non-GAAP tax rates are expected to be 14.5%, plus or minus 1%, excluding any discrete items.

Prior to the earnings release, there were three primary concerns.

- Long term order demand and the supply chains ability to meet that demand.

- Effect of US restrictions regulating sales of Nvidia chips to China

- How are corporations going to monetize AI.

The following quotes addressed the first two issues

Supply/Demand

“we do expect to continue increasing, ramping our supply over the next quarter, as well as into next fiscal year.”

“The world has something along the lines of about $1 trillion worth of data centers installed in the cloud and enterprise and otherwise. And that trillion dollars of data centers is in the process of transitioning into accelerated computing and generative AI. We’re seeing two simultaneous platform shifts at the same time. One is accelerated computing, and the reason for that is because it’s the most cost-effective, most energy-effective, and the most performant way of doing computing now. And so — so, what you’re seeing — and then, all of a sudden enabled by generative AI — enabled by accelerated computing, generative AI came along. And this incredible application now gives everyone two reasons to transition, to do a platform shift from general purpose computing, the classical way of doing computing, to this new way of doing computing, accelerated computing… The best way for companies to increase their throughput, improve their energy efficiency, improve their cost efficiency, is to divert their capital budget to accelerated computing and generative“

US Restrictions

“We believe the current regulation is achieving the intended results. Given the strength of demand for our products worldwide, we do not anticipate that additional export restrictions on our data center GPUs, if adopted, would have an immediate material impact to our financial results. However, over the long term, restrictions prohibiting the sale of our data center GPUs to China, if implemented, will result in a permanent loss of an opportunity for the U.S.”

what does that mean at stockmarketHQ

- Exceptional quarterly report

- Exceptional forward guidance based on Data Centre demand

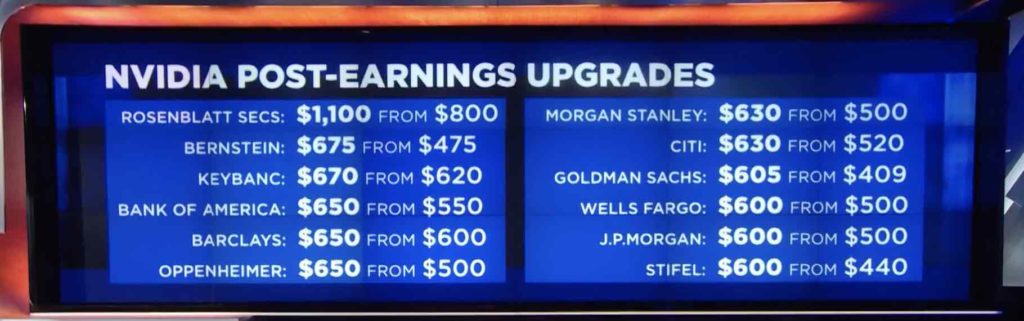

This is reflected in the change to analyst estimates after the report.

However, there is a disconnect that exists in the short term.

‘Data Centre’ accounted for $10.3B of quarterly revenue, up 141% from the June quarter ($4.3B), compared with ‘Gaming’ which accounted for $2.5B of revenue, up 11%, compared to $2.2B in the June quarter.

This tells us that the consumer ‘demand’ (gaming GPU’s) is effectively stagnant with growth at 11%. The entirety of NVDA’s revenue growth came from ‘Data Centre’ demand.

Three comments stand out by CEO Jenson Hueng

- “The industry is simultaneously going through two platform transitions: accelerated computing and generative AI.”

- “There’s about $1 trillion worth of data centers, call it, a quarter of trillion dollars of — of capital spend each year.”

- “The best way for companies to increase their throughput, improve their energy efficiency, improve their cost efficiency, is to divert their capital budget to accelerated computing and generative AI.”

Jenson Hueng’s thesis is that companies and Data Centres must transition to the ‘accelerated computing and generative AI’ platforms because it reduces costs and improves efficiency, which it undeniably will over the long term.

The disconnect between making that transition and how companies will pay for it has not been resolved. NVDA’s profit comes from selling chips to Data Centres, however, it also comes as an expense to those Data Centres. ‘Cost Savings’ covers a portion of that expense, but ultimately, revenue has to be generated by the consumer (demand by society) to pay for that expense and generate additional profit for the corporations.

Think of Apple. Society pays $80B each three months for iPhones and services for which there is both a ‘want’ and a ‘need’ which creates demand.

At the moment, there is no ‘want’ or ‘need’ use of AI or accelerated computing that Society is willing to pay for, the ‘demand’ has not been created.

In the NVDA stockmarketHQ INVESTMENT THESIS and trade alert at a stock price of $140 we put forth the prospect that … ’The Next Big Thing’ is happening and it’s going to be powered by chips’.

The stock price has risen to $500.

That price rise has come as a result of short term Data Centre demand to build the infrastructure that will power ‘The Next Big Thing’, paid for by cost savings.

The next leg up in Nvidia’s stock price is going to be dependant on the creation of a Secular Growth Trend, a change in the way society behaves that stimulates a new demand (think iPhone), which sustains the demand for Nvidia’s chips.

Where the stock price goes from here is up to the Big Money Managers to set a stock price valuation which bridges the short term ‘infrastructure development’ demand by Data Centres and the long term ‘secular growth trend’ demand created for consumers.

At stockmarketHQ, we might consider that bridge, ‘Speculation’.