There’s an old joke – What Colour is a Deer? Any farmer will answer ‘Green’. Farmers feed the world and John Deere makes the most recognizable machinery in the world. With a global population exploding from 6.1 billion in 2000 to over 8.1 billion in 2023 and continuing on that trajectory, efficiency of land use, yields and man hours to operate machinery will become increasingly important. John Deere operates in three segments, Agriculture and Turf (A&T), Construction and Forestry (C&F) and Financial Services , covering the broad spectrum of the diversified global resource base as well as the financing to support it with 1900 dealers in North America and 3700 dealers globally .

There are Five Secrets to a Successful Trade

- Choose the Right Stock

- 90% Probability factor

- Strategy and Execution

- Manage Risk

- Repeat Successive Trades

1. Choose the right stock

The First Secret to a Successful Trade is to choose the right stock.

The first step to choosing the right stock for a trade is to ask yourself a simple question, “What is the reason that Big Money Managers would put millions of dollars into this stock?” This forms the ‘INVESTMENT THESIS’.

The Investment Thesis for Deere is founded on Three Pillars

- Technology and AI – Deere is a leader in the application of new technologies such as GPS and AI as part of the evolution of Intelligent Agriculture. Growing global population base will require increasingly efficient use of land, yields and man hours in crop production.

- Government Spending – 2024 is a US election year which will carry promises of infrastructure development for job creation and farming subsidies to capture votes.

- Economy and Interest Rates – A strengthening economy will increase construction, inflation reduction will decrease material input cost for manufacturing equipment, lower interest rates will support an equipment replacement cycle through lower financing costs.

At stockmarketHQ, we start with a very simple framework

- Best in Class Company

- Secular Growth Trend

- Strong Macroeconomic Environment

Choosing a ‘trading stock’ with a strong ‘Investment Thesis’ provides the stability and predictability that only big financial institutions can provide.

The second step to choosing the right stock for a trade is to ask yourself the question, “What is the reason that Big Money Managers will buy the stock ‘right here, right now’”?

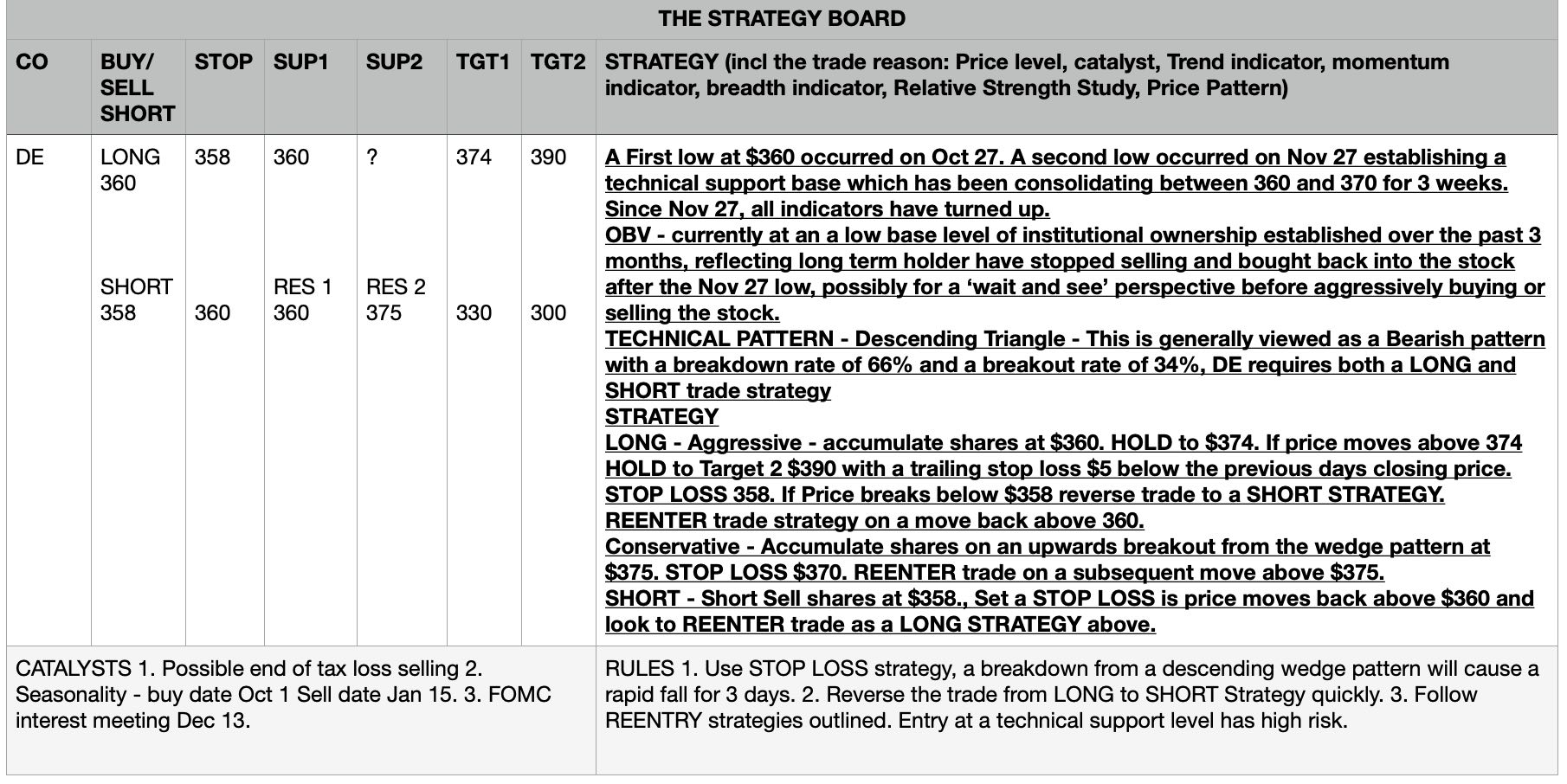

TRADE REASON -The stock price is currently at an inflection point providing both a Long and a Short Selling strategy.

- LONG STRATEGY – The Technical Analysis trade set up reflects the stock has been recovering from an ‘Oversold Condition’ on all technical indicators. Price is establishing a six week base at $360 with Volume By Price reflecting few potential sellers at this level, more specifically anyone selling at $360 were Buyers at higher prices and are currently selling at a loss. Although price has not moved, the indicators reflect money has been flowing into the stock creating a Positive Divergence between a consolidating price and rising technical indicators.

- SHORT STRATEGY – The Descending Triangle technical pattern is considered a Bearish formation with price breaking down from the triangle 65% of the time and breaking out to the upside 35% of the time.

2. The 90% Probability Factor

The Second Secret to a Successful Trade is to buy the right stock, at the right time.

At stockmarketHQ we try to target a 90% probability of success by using Technical Analysis to see what the Big Money Managers have done and understanding what they will have to do going forward.

NOTE: At $360 the stock is at an inflection point providing a 90% probability that the stock price either breaks down or starts a new uptrend requiring both a Long and Short Selling strategy.

- Money Flow Index (20 is ‘Oversold’, 80 is ‘Overbought) – currently neutral at 49 the stock has been in an upwards trend recovering from an oversold condition. An increase in the MFI would reflect new money coming into the stock.

- MACD Momentum indicator is flat recovering from a low position. A turn up of the black line would be a Buy Signal.

- On Balance Volume reflects Institutional selling through October and November followed by institutional buying in December.

- Volume-by-Price reflects very few potential sellers below the $360 price level.

- Price is establishing a six week base at $360.

SEASONALITY – The seasonally strong period for Deere reflects a strategy with a Buy Date of October 1 and a Sell Date of January 15 has provided an average return above the S&P500 in 18 of the past 20 years. October 29 to May 10 is the period of Seasonal Strength for the Industrials sector (source equityclock.com).

SEE TECHNICAL ANALYSIS CHART BELOW

3. Strategy and Execution

The hardest part of trading is overcoming the two most powerful emotions of ‘Fear’ and ‘Greed’. Warren Buffett famously stated, “be fearful when others are greedy, and greedy when others are fearful.” The problem is, when it comes time to buy, you won’t want to. When it comes time to sell, you won’t want to.

The Third Secret to a Successful Trade is to develop a strategy, and to execute that strategy.

1. AGGRESIVE

- ENTRY – Accumulate shares at the lowest risk price of $$360.

- PROFIT – consider taking profit at Target 1: $375. If MACD Momentum crosses above the ‘Zero’ line at Target 1, that would be a ‘Buy Signal’ confirmation. and consider holding to Target 2: $390 while raising the STOP LOSS to $5 below the current price.

2. CONSERVATIVE

- ENTRY – Accumulate shares on a price move above the downwards sloping trend line at $$374 with confirmation by the Technical indicators.

- PROFIT – consider taking profit at Target 1: $390. If MACD Momentum crosses above the ‘Zero’ line at Target 1, that would be a ‘Buy Signal’ confirmation. and consider holding to Target 2: $390 while raising the STOP LOSS to $5 below the previous days closing price.

3. SHORT SELLING – Short Sell shares at $358., Set a STOP LOSS if price moves back above $360 and look to REENTER trade as a LONG STRATEGY above. NOTE: Short Selling is an advanced strategy and carries increased risk.

| STRATEGY | ENTRY | STOP LOSS | TARGET 1 |

| AGGRESSIVE | $360 | $358 | $375 |

| CONSERVATIVE | $375 | $370 | $390 |

| SHORT | $358 | $360 | $330 |

4. Manage Risk

The Fourth Secret to a Successful Trade is to manage risk.

STOP LOSS – $$358 represents a $2/share loss. If the stock price drops below $$358 there is no secondary technical support level. Look to re-enter the trade if the stock recovers and makes a subsequent move above either $$360 or $374 using the stated LONG Strategy and Execution – Aggressive or Conservative. As price moves up towards Target 1 and Target 2 consider raising the Stop Loss to $5 below the days closing price.

POSITION SIZE – using a STOP LOSS of $$358 represents a $2/share downside risk. As a general rule of thumb, consider dividing the total risk you are will to accept by $2 to determine the number of shares to build into this position.

NOTE: $2 is a very tight STOP LOSS. It is better to take a small loss then allow the small loss to turn into a large loss. A breakdown below $358 may see prices decline rapidly for 3 to 5 consecutive days.

5. Repeat Successive Trades

Compounding is the most powerful force in any investment

The Fifth Secret to a Successful Trade is putting together a string of profitable trades.

Price will enter and establish a new trading range either between $360 and $375, or if price moves above Target 1, there will be a longer term Trend Change signalling higher prices.

what does that mean at stockmarketHQ

The Long Strategy is supported by technical indicators that are strengthening under the surface while price remains within the $360-$370 range. Seasonality suggests that Deere (DE) has lagged its normal seasonal performance and other industrial peers such as Caterpillar, Boeing and Cummins providing a ‘catch up’ opportunity for Deere if the December 2023 rally expands.

The Short Strategy is supported by the concept of Tax Loss selling in which big financial institutions sell their ‘losers’ before the end of the year to offset gains in profitable stocks. This would create supply in the market and put downwards pressure on price below $358.

Statistically, even the best traders have a 30-35% success rate.

Following the stockmarketHQ Five Secrets to a Successful Trade targets a 90% probability of a successful trade while minimising risk. From an Inflection price of $360, the Long and Short strategy provides a 90% probability of catching the trade in the direction of the breakout from the Descending Triangle with the potential to provide a 5-20% profit while limiting downside risk to approximately 2%.

|

DISCLAIMER – all information is provided for educational purposes only, with no guarantee of the outcome. No investment should be made based on any ideas or opinions of the author. No investment decision should be made without first conducting your own due diligence and research including but not limited to company prospectus, all public filings by the issuer of the security, security charts and all other publicly available information. Information on trade ideas and opinions may or may not be updated on a regular basis and the author assumes no responsibility to do so.