KEY POINTS

- The most consistent profits are made when the market is in a stable uptrend. When markets turn Volatile, it’s important to adapt to the market. Changing from a ‘Buy and Hold’ strategy to reallocating funds to a ‘Trading’ strategy can lead to outperforming the broader market.

- Every Investor or Trader has

their own style. Being a successful trader isn’t about knowing everything there is to know about the stock market, it is about finding a few techniques that fit your style, mastering them and repeating them successfully. - Trading in a volatile market requires an understanding of what Volatility is and how the Big Money Managers use it to their advantage.

- Choosing the right stock with the correct entry and exit price, while maintaining a defensive strategy, are the components

to a successful trade in a high volatility market.

WHAT IS VOLATILITY

We all see a

Volatility is generally caused by some ‘Catalyst’ such as news events, earnings reports, geopolitical threats, macroeconomic risks or global pandemics.

Like everything Wall Street, Big Money Managers need an ‘Edge’ to maximize profits. So, a mathematician came up with a way to measure and predict volatility by dividing the number of ‘Put’ options by the number of ‘Call’ Options. A ‘Put’ option is a bet that the market is going down and a ‘Call’ option is a bet that the market is going up.

This ratio is called the ‘Volatility Index’ and is widely referred to as the Stock Market ‘Fear Gauge’. Because market technicians love charts, they have even put Volatility into a graphical format.

Volatility Index readings can be grouped into different levels.

VIX between 10 – 13

This a very low reading and reflects a market

VIX between 14 and 17

There’s a potential ‘catalyst’ and Big Money managers begin to assess whether this is a ‘Risk’, ‘Threat’ or the increased possibility of an actual ‘Event’. This can be considered a ‘waiting period’ with a 50/50 chance of a move in either direction.

VIX between 17 and 22

A ‘Bad News’ catalyst has been publicly disclosed and can be considered a ‘Threat’. The government has likely been called to action to find a solution. Big Money Managers are preparing to simultaneously capitalize on both weakness and strength using complex strategies.

VIX above 23

The ‘Threat’ has already

HOW DO BIG MONEY MANAGERS USE VOLATILITY

Step #1 – Find the expected daily price range of the market or stock.

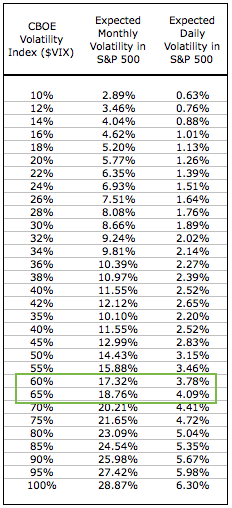

The Volatility Index chart above (www.stockcharts.com ticker $VIX) reflects periods of extreme High and Low Volatility. The extreme high is associated with the 2020

With a Volatility Index reading of 62.70 we can find the expected daily percentage move in the stock market from the chart which we can use to figure out the expected price change, from ‘High’ to ‘Low’, of any given stock which should be approximately 3.78% – 4.09%.

CHOOSING THE RIGHT STOCK

Step #2 – evaluate the catalyst as a ‘Risk’, ‘Threat’ or ‘Event’ and choose a stock with minimal exposure to that catalyst.

Choosing the right company with a strong ‘Investment Thesis’ sets up a successful trade and provides the underlying support of large institutions holding the stock within their portfolio.

An Investment Thesis is the ‘reason for owning the stock’ and is founded on three pillars

- Best in Class Company – strong balance sheet, effective strategy and an experienced management team to capitalize on that strategy.

- Secular Growth Trend – a product or service which changes societal behaviour

- Strong Macroeconomic Environment – Strong employment, low interest rates, high consumer confidence.

Volatility is almost always associated with a catalyst which potentially compromises one of those three pillars.

Having five ‘investment’ quality stocks provides flexibility to choose one for the trade entry. Each will have a different return for the day and we might not choose the one that has the biggest return for the day, but the objective is to make a profit with the minimum possible risk.

THE SETUP

The Setup for this trade capitalizes on a phenomenon called the ‘Opening Rotation’ which occurs during the first 60 – 90 minutes after the Opening Bell. The Opening Rotation occurs for two reasons

- Futures contracts – A Call Option is a bet that a stock price will go up, a Put Option is a bet that a stock price will go down. Unlike stocks, Call and Put Options have to wait until after the opening bell to trade. If there is a news event that causes the market or a stock price to go up, holders of Put Options are forced to buy (they bet the stock price would go down, so they lose money when it goes up) which drives the stock price higher. If the news drives the stock price down, Call Option holders are forced to sell (they bet the stock price would go up so they lose money when it goes down), further driving the stock price down.

- At-The-Open stock orders – an order to buy or sell stocks immediately at the open, in reali

ty, it takes a period of time to fill all orders. Investors place At-The-Open orders to get ahead of other investors if they feel the stock is going to move a particular direction.

The small investor or trader has the ability to capitalize on the strategies of Big Money Managers, Hedge Funds and Computer Algorithm Programs which provide the Setup for THE ENTRY in a High Volatility Market.

THE ENTRY

Step #3 – wait for the entry trigger.

The objective is to choose the stock with the biggest difference between our entry price and the ‘Expected Daily Volatility in S&P500’ percentage value. With a VIX of 62.7 we would use about 3.9% as a reference.

There are two types of initial moves at the open of the stock market which trigger an entry

- Large Volume Selloff

- Large Volume Buying followed by a selloff

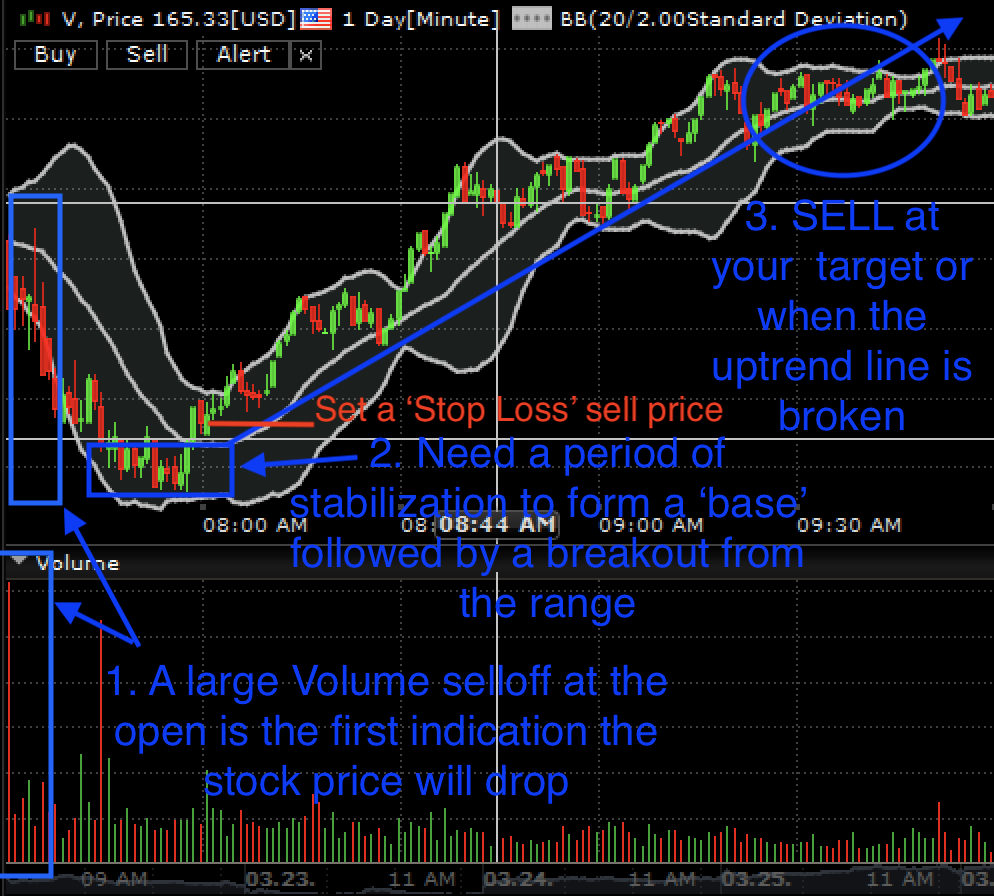

Large Volume Selloff

- A large volume selloff (the really high red bar under ‘Volume’) at the stock market open is the first indication that the stock price will drop.

- Need a period of stabilization to form a ‘base’ which sets up the reversal. A breakout above this range is the trigger for an entry point.

- With Visa’s entry price being down -4.5%, this is greater than the expected daily Volatility range of only +/- 3.9%, this is a low-risk trade.

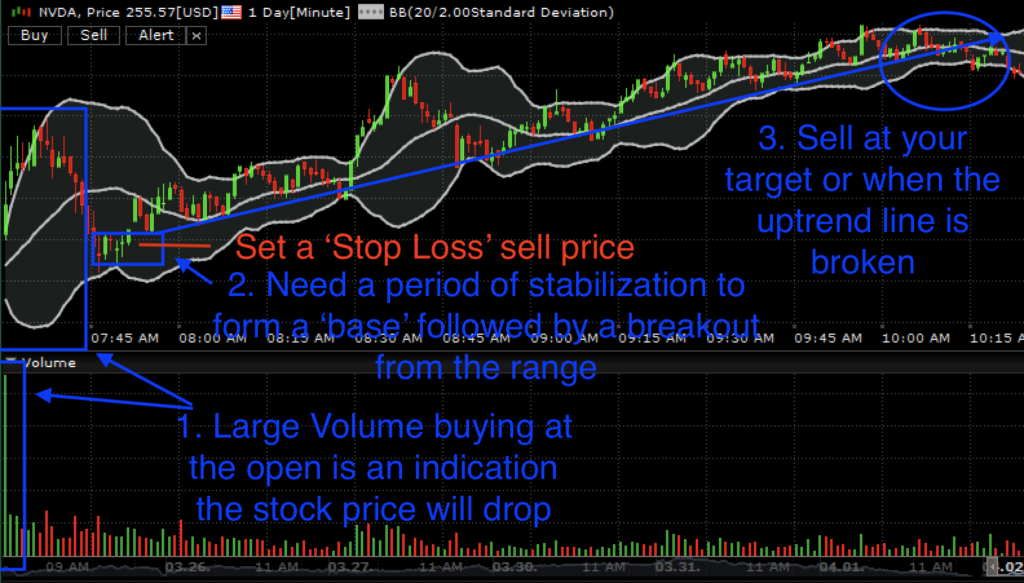

Large Volume Buying Followed by a Selloff

- Large Volume Buying (the really high Green bar under ‘Volume’) at the stock market open is an indication that the stock price will subsequently drop.

- After the price drop, need a period of stabilization to form a ‘base’ which sets up the reversal. A breakout above this range is the trigger for an entry point.

- With Nvidia’s entry price being down -6.2%, this is greater than the expected daily Volatility range of +/- 3.9%, this is a low-risk trade.

THE EXIT

Step #4 – Set your Sell Price order or sell when the ‘uptrend’ line is broken.

The hardest part of trading is selling a stock which has gone up. Taking a profit at the target takes discipline.

In a High Volatility

In the example above using Visa, the entry price was $161.80 x 1.85% = $164.80 however the uptrend line wasn’t broken until $167.50.

Note: If the choice is made to hold the stock above the Target Price, place a Trailing Stop Loss Sell order with a fixed amount or fixed percentage so that if the price falls back down the order will automatically trigger the sale and lock in your profit.

This is a strategy based on the Opening Rotation during the first 60 – 90 minutes from the market open. Win, Lose or Draw exit the trade.

Don’t be greedy, a profit is a profit.

THE DEFENSE

Step #5 -set a ‘Stop Loss’ sell order. Risk management is the most important aspect of trading in a Volatile market.

If the stock price drops back into the ‘Stabilizing’ period, there is a very high probability it will continue to decline.

In the Visa example above, with an Entry price at $161.80 consider using a ‘Stop Loss’ price at or just a little below the Entry price and within the ‘Stabilization’ period’ (possibly $161.30).

This example of Nvidia highlights a Large Volume Selloff at the open, followed by a stabilization ‘Base’ with a subsequent breakout which triggers a Trade Entry. However, the price then drops back into the ‘Base’ and continues to decline. This is a failed trade.

Maintaining a ‘Stop Loss’ order helps to take the emotion out of selling and keeps a small loss from turning into a big loss. Shares can always be bought back when the trade sets up again for the uptrend or even consider moving onto one of the other five stocks.

what does all that mean at moneywiseHQ

Reallocating a portion of funds from an ‘Investing’ strategy to a ‘Trading’ strategy can generate profits in a High Volatility market. When the market recovers to the long term uptrend, reallocate those funds back into long term investments.

There are five components to a successful trade

- Use the Volatility Index to find the expected daily price range of the market or an individual stock.

- Choose five investment quality stocks to consider for a trade

- Entry strategy – wait for an entry trigger

- Exit Strategy – Set a

sell price at your target or when the uptrend line is broken - Defense – maintain a ‘Stop Loss’ sell order to manage risk.

This is a strategy for trading ‘Investment Quality’ companies in a high volatility market. The objective is to make a profit of roughly half of the expected price change in a stock. Generally, this will be 1 – 2%.

Always remember Rule #1. Protect your money. If you don’t protect your money, someone else is going to take it away from you.

Big Money Managers always need an ‘edge’ to outperform. Understanding volatility and how to