CASE STUDY – JUST BUY STUFF WITH PLANES?

- Airlines and cruise lines have become the new hot stocks of the market for a new generation of investors hoping for a repeat of the 2001 and 2009 industry recoveries.

- CEO’s, who manage $45 Billion in annual sales through advanced revenue and capacity management systems, have been disclosing the realities of the industry challenges and recovery. It’s important to look at what is actually happening in the industry vs what the stock market tells us the industry should be doing.

- The Technical Analysis reflects a whole sector of stocks which has reached an ‘Extreme Overbought’ condition and represents an excellent opportunity as a Case Study.

THE

Capacity was cut by 90%. Planning for increases, as restrictions ease and demand rises, to approximately 75% of previous years levels for the summer, 50% by the end of the year.- Planning for the worst, hoping for the best.

- Airlines would come out of the Covid-19 pandemic as smaller operations.

- The recovery pattern in air travel would be in the following order: Domestic, visiting friends and relatives, Transborder, business, International then leisure (vacations).

- Industry travel recovery could take 2 to 3 years to return to

pre Covid-19 levels. - United Airlines announced a cash burn of $45M/day. Air

canada announced a cash burn of $22m/day

To date we have seen the following actions by the airlines

- Air Canada announced a workforce

reductio of 50-60% and currently has 79 of 220 aircraft parked. - United airlines saying off 4400 of 12,000 pilots

- Westjet Airlines has announced 1700 pilot layoffs

- American reducing 30% of office jobs and planning for 20% long term capacity reduction for summer 2021.

- Boeing has reported order cancellations and deferrals and only four deliveries in May.

In May, Warren Buffett disclosed that Berkshire Hathaway had closed all four of his airline positions.

TECHNICAL ANALYSIS

AMERICAN AIRLINES (www.stockcharts.com ticker AAL)

American Airlines is representative of an ‘Extreme Overbought’ stock.

Money Flow Index (80 is ‘Overbought’ 20 is ‘Oversold’): Current 90. Money has flowed into AAL very rapidly and has reached an extreme ‘Overbought’ condition.

MACD Momentum: this is in an uptrend, however the level is above where it was during the February peak.

On Balance Volume (OBV) (Indicates accumulation or selling of shares by investors): The number of shares that have been bought by investors far exceeds those bought by investors during the February peak.

SOUTHWEST AIRLINES (www.stockcharts.com ticker LUV)

The technical indicators are almost identical to those of American Airlines. However, recall from above, the anticipated order of air travel recovery: Domestic, visiting friends and relatives, Transborder, business, International then leisure (vacations). LUV is a

Money Flow Index (80 is ‘Overbought’ 20 is ‘Oversold’): Current 92: Money has flowed into LUV very rapidly and has reached an extreme ‘Overbought’ condition.

MACD Momentum: this is in an uptrend, however the level is above where it was during the February peak.

On Balance Volume (OBV) (Indicates accumulation or selling of shares by investors): The number of shares that have been bought by investors far exceeds those bought by investors during the February peak.

BOEING (www.stockcharts.com ticker BA)

Money Flow Index (80 is ‘Overbought’ 20 is ‘Oversold’): Current 91: Money has flowed into BA very rapidly and has reached an extreme ‘Overbought’ condition.

MACD Momentum: this is in an uptrend, however the level is above where it was during the February peak.

On Balance Volume (OBV) (Indicates accumulation or selling of shares by investors): The number of shares that have been bought by investors far exceeds those bought by investors during the February peak.

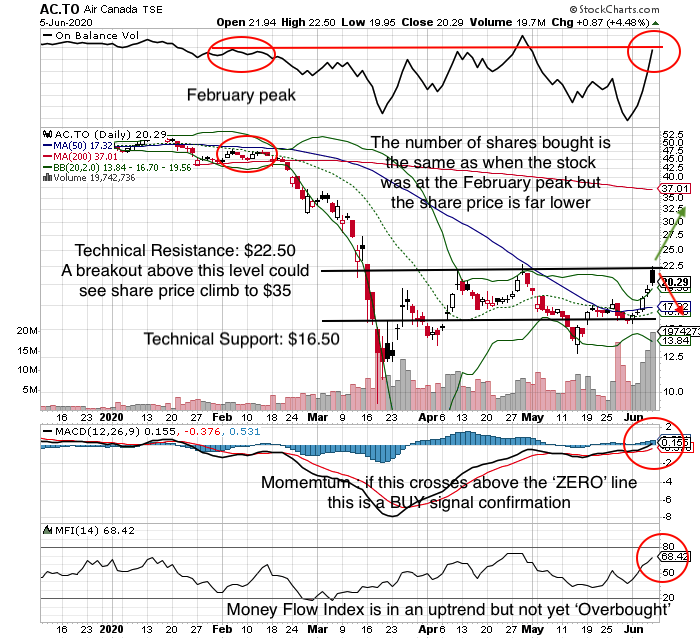

AIR CANADA (www.stockcharts.com ticker AC.TO)

Money Flow Index (80 is ‘Overbought’ 20 is ‘Oversold’): Current 68: Money has flowed into Air Canada very rapidly, however at 68 there is still room for more upside but this is also at a level where profit taking has occurred previously.

MACD Momentum: Is right at the ‘ZERO’ line. If the Black Line crosses above the ‘ZERO’ line this would a ‘BUY’ signal confirmation, if it turns below, this would be a ‘SEL’ signal.

On Balance Volume (OBV) (Indicates accumulation or selling of shares by investors): The number of shares bought by investors is at the same level as the February peak.

Technical Resistance $22.50 If the share price breaks above this level, there is very little resistance until between $32 – $35.

Technical Support: $16.50 if the share price does not breakout above $22.50 it is likely to pullback to a price of $16.50 and may establish itself within the trading channel.

Why has Air Canada stock lagged the US Industry?

There are four concerns which may be keeping the stock price down

- It is a Canadian Airline which does not have the same presence to American Investors as the US counterparts.

- In 2019 the Company committed to buyout leisure airline Air Transat (TRZ.TO) for $18CAD/share for a total of $720M CAD. The Covid-19 pandemic has crushed Transats stock price to $6. In

effect Air Canada is overpaying by about $480M. This buyout is currently under review by the Canadian and European regulators. - Air Canada recently issued a public share offering of 35M shares at $16.25/sh for a total of $575M.

Stock price is a function of profit divided by the number of shares (called EPS for Earnings Per Share). When the EPS decreases, the stock price generally decreases. Further, companies often sell shares when they feel their stock price is highly valued to capitalize on market conditions. They buy back their shares when they feel their stock price is undervalued. - Canadian Airlines have not received a ‘bailout’ like the US airlines. This puts them at a financial disadvantage. In the recovery process, airlines will try to capitalize on other

carriers weaknesses to gain market share.

What does all that mean at moneywiseHQ

Just buy ‘stuff’ with planes in it, seems like a no brainer, the stocks only go up.

There are behaviour patterns ingrained in society and business

- People will still fly

- Borders will re-open

- The growth of the global

middle class can not be stopped. - People who are pent up from lockdowns will want to go on vacations.

- Businesses won’t substitute large financial deals made via Zoom for

in person meetings. - Governments will bail airlines out and the US has provided $25B in loans to airlines and recently Germany announced a $9.8B bailout for Lufthansa and Hong Kong $5B for Cathay Pacific.

- Airlines have traditionally capitalized on crises as an opportunity to streamline operations, refinance and restructure debt obligations and obtain

labour concessions from their employees in order to reduce costs and improve efficiency.

Airline Industry CEO’s have been very clear that the recovery could take 2-3 years. Over the long term, the Investment Thesis can not be denied, stock prices will go up… over the next 2-3 years.

A recent article by Bloomberg titled “‘Bored’ Millenial Day Traders Boost Airline ETF’s Assets 2,930%” expressed that an obscure Exchange Traded Fund, ticker symbol ‘JETS’, saw money inflows grow from $33 million in March to over $1 Billion as new traders wanted to catch the bottom based on the history of the strong rebound in airlines after the 2001 terrorist attacks and the 2008 financial crisis.

It really is that easy, and apparently the entire world has also figured that out, at exactly the same time.

The impact of the ‘Bored Millenial Day Traders’ is reflected in the number of shares (

The ‘Fundamental’ analysis is different. Cash Burn is hundreds of millions of dollars a month. Thousands of pilots and flight attendants, who are required to fly the planes, are laid off which requires a costly and lengthy recall process. CEO’s have expressed that they will come out of the pandemic as smaller operations.

While US airlines have had a fast move, there is potential for long term gains. Boeing could gain certification approval for the 737 MAX and the stock may go to $300. If Air Canada is able to get out of the Air Transat deal or there is some kind of government bailout program, the stock may go to $35. And maybe those

At moneywiseHQ there is a strategy we follow, choose the best quality companies with strong ‘Fundamentals’ (business model, management team, financials) combined with a Technical Analysis which provides at least a 90% probability of success.

One of the secrets to successful investing is being prepared for opportunity when it comes. In time, the opportunity will present itself in the aviation industry