Every trade has to be supported by an underlying Investment Thesis, or reason, why the big financial institutions would hold a company in its portfolio. That Investment Thesis provides the foundation on which a Fast Trade can be made when there is a dislocation between the stock price and the intrinsic value of the company.

CHOOSE THE RIGHT STOCK

The Full Investment Thesis for AAPL can be found here

APPLE INVESTMENT THESIS (click here)

TRADE THESIS

The Trade Thesis is is founded on 3 pillars

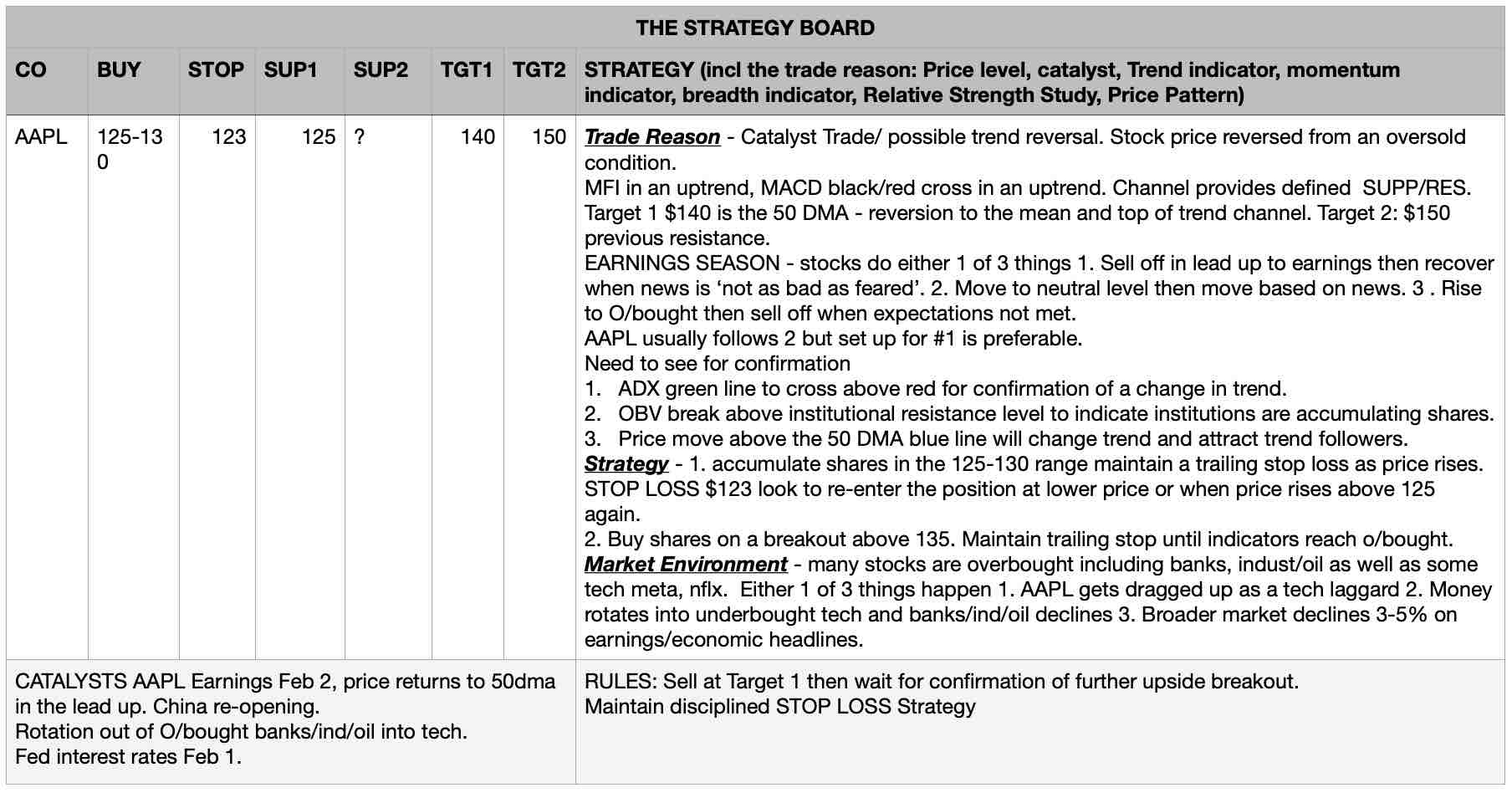

- Rotation – $4.3 Trillion on the sidelines waiting to come back into the market. Big institutions have been hiding out in Banks, Industrials, Oil. They will rotate into stocks with the highest profit potential.

- Economic – The macroeconomic environment has been strong resulting in the US federal Reserve raising interest rates rapidly which has drastically affected tech stock prices and causing fear of recession. If the US Fed Reserve slows the pace of interest rate increases or even reduces them over the next 6 – 9 months tech stocks will rise. If the US economy enters into a recession which is not as bad as feared sales will be minimally affected. The reopening of China will add to the global growth environment in terms of consumption, production and supply chain.

- Negative Catalyst Elimination – When a stocks price is driven down by perceived ‘Threats’ to it’s Investment Thesis, rather than actual company specific reports, as each of those threats is removed, the stock price will recover.

AAPL has been affected by a number of issues which have threatened the profitability.

- China Covid Lockdowns – this has affected consumer spending in china as well as production.

- Interest rate increases – as interest rates rise, the standard Big Money Manager playbook is to rotate out of tech

- Supply Chain – ability to deliver product from production countries to consumer countries.

- Recession/Economy – Hard landing recession would affect employment and discretionary spending of consumers.

- Strong US dollar – High US dollar negatively affects profits from foreign exchange for companies with large international sales.

- Commodity/input costs – high prices for aluminum and steel used in hardware production affects profit margins.

Each of these issues has started to resolve.

RISKS

- Earnings Season – Earning Season is an extremely volatile period with large price moves. Companies that beat earnings estimates or provide positive guidance will be bought. Company its that miss analyst estimates or provide lighter than expected guidance will be attacked by short sellers. in the lead up to an earnings report, a stocks price will take one of three pricing patterns

- Price will run up to an ‘Overbought’ condition in the lead up to the report, then sell off when it does not meet the high expectation.

- Price will move to a Neutral position as investors wait for the actual earnings report before deciding to commit to, or sell, a stock.

- Price will drop to an ‘Oversold’ condition as investors minimize exposure and risk prior to the earnings report. Then when the report is ‘Not-as-bad-as-feared’ investors will have the confidence to buy back into the stock again.

AAPL reports earnings February 2 and the stock price pattern will have to be monitored closely.

2. Federal Reserve Interest Rate announcement February 1 – This is the day immediately before AAPL’s earning report. With each interest rate announcement the market has been affected by speculation on what the rate increase will be. As of January 17, the expected announcement is for 0.25%. If the Fed raises rates to a higher level, tech stocks will be negatively affected.

3. Buyback blackout period – Apple’s greatest strength is the defense to short selling attacks in the form of a $20 billion per quarter stock buyback period. During the period from the end of the quarter to 48 hours after the earnings release the company is restricted from buying back shares, leaving it unable to defend it’s shares against a short selling attack.

4. Seasonality – The seasonally strong period for tech stocks is October to mid February. Apple’s strongest period is June through October is is offset from the broader tech sector.

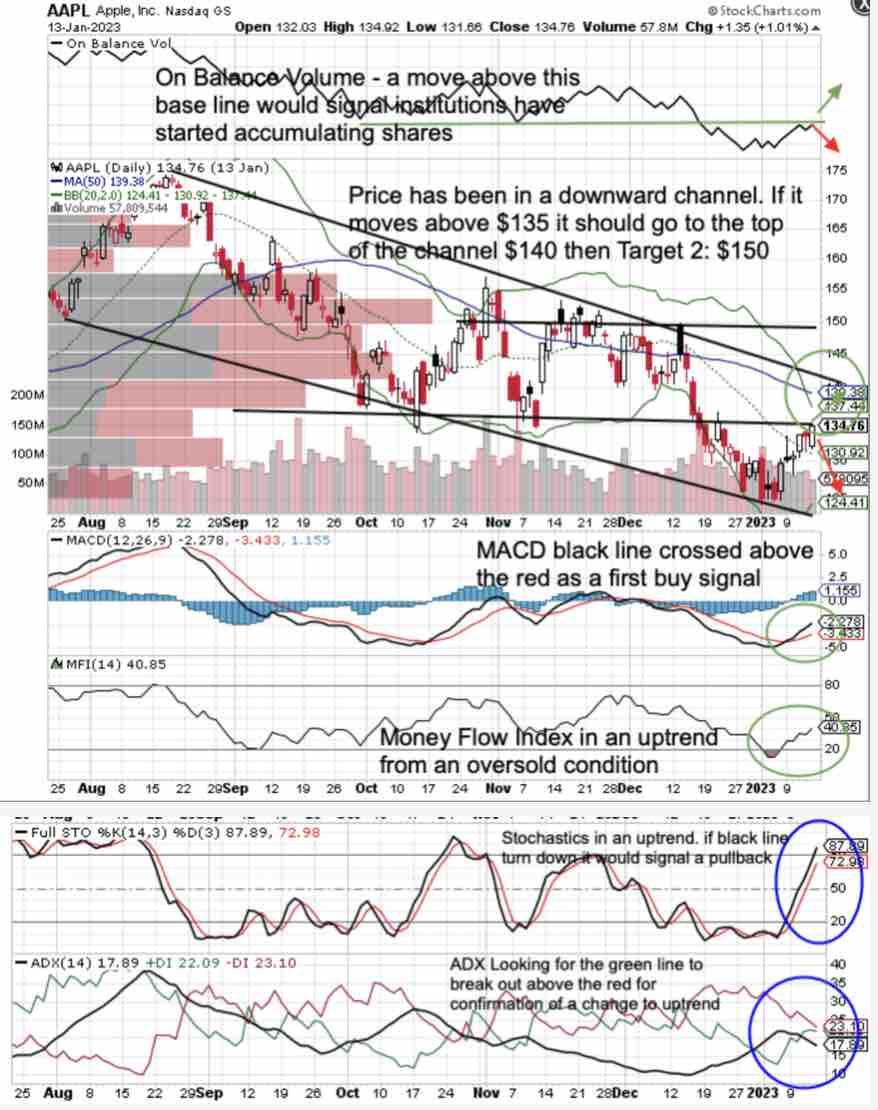

| TECHNICAL CHART ANALYSIS |

|

|