The 2023 year end tax loss selling by big financial institutions and the end of the United Nations COP28 Climate Summit on December 12 without a resolution to eliminate fossil fuel use may be the two catalysts combined with a 4.2% dividend yield that brings money back into Chevron, providing a Fast Trade opportunity in a company supported by a strong Investment Thesis.

There are Five Secrets to a Successful Trade

- Choose the Right Stock

- 90% Probability factor

- Strategy and Execution

- Manage Risk

- Repeat Successive Trades

1. CHOOSE THE RIGHT STOCK

The First Secret to a Successful Trade is to choose the right stock which attracts Big Financial Institutions and provides the foundation on a which a Fast Trade can be made. There are three components to this: 1. The stockmarketHQ Framework 2. Investment Thesis 3. Trade Thesis

STOCKMARKETHQ FRAMEWORK

1. Best in Class – CVX is one of the largest major integrated oil companies in North America. For Fiscal 2022 they reported a profit of $36.5B, paid out $26B to investors through dividends and share buybacks and announced a further $75B share buyback program over 5 years.

2. Secular Growth Trend – is a change in the way society behaves. The strong movement by Governments to reduce fossil fuel consumption through environmental regulation and a movement towards electrification will work to slow the overall growth in oil consumption, However, the world runs on oil, societies infrastructure is founded on oil, and the oil/electrification transition is expected to take approximately 30 years.

3. Strong Macroeconomic Environment – As of January 2023 the US economy is strong, inflation at 3.1% is decreasing towards the US Federal Reserve target of 2%, US unemployment rate is 3.7%.

INVESTMENT THESIS

The Investment Thesis is founded on 3 pillars

- Dividend and Share Buyback program

- Oil Supply/Demand

- Institutional Ownership

TRADE THESIS

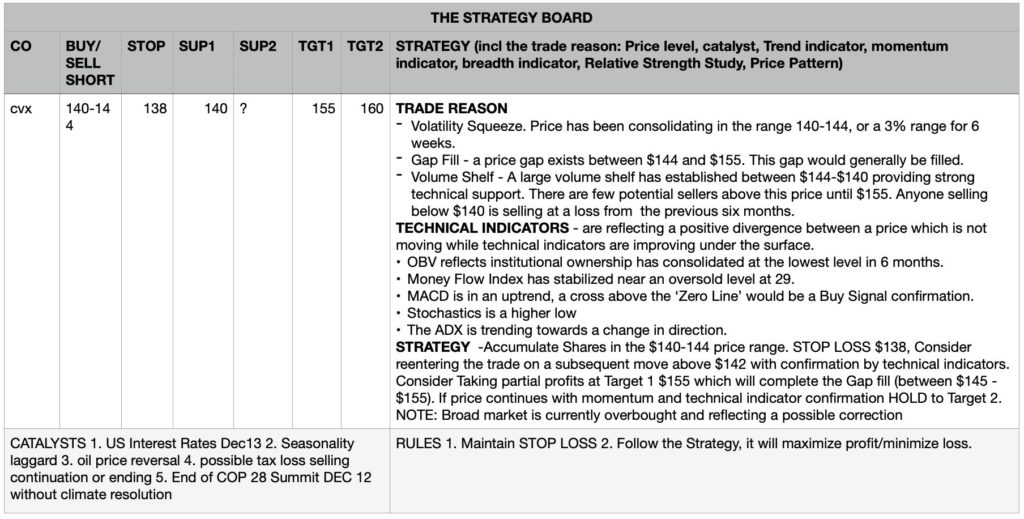

This is a technical trade supported by three established trading patterns and two catalysts which may cause a reversal in trend.

- Volatility Squeeze. Price has been consolidating in the range 140-144, or a 3% range for 6 weeks.

- Gap Fill – a price gap exists between $144 and $155. This gap would generally be filled.

- Volume Shelf – A large volume shelf has established between $144-$140 providing strong technical support. There are few potential sellers above this price until $155. Anyone selling below $140 is selling at a loss from the previous six months.

- Possible Catalysts – End of United Nations COP28 Climate Summit without resolution to eliminate use of fossil fuels. Completion of 2023 year end tax loss selling. 4.2% dividend becomes attractive if interest rates decline.

2. THE 90% PROBABILITY FACTOR

The Second Secret to a Successful Trade is to buy the right stock, at the right time. At stockmarketHQ we try to target a 90% probability of success by using Technical Analysis to see what the Big Money Managers have done and understanding what they will have to do going forward.

TECHNICAL INDICATORS – are reflecting a positive divergence between a price which is not moving while technical indicators are improving under the surface.

- OBV reflects institutional ownership has consolidated at the lowest level in 6 months.

- Money Flow Index has stabilized near an oversold level at 29.

- MACD is in an uptrend, a cross above the ‘Zero Line’ would be a Buy Signal confirmation.

- Stochastics is a higher low

- The ADX is trending towards a change in direction.

3. STRATEGY AND EXECUTION

The Third Secret to a Successful Trade is to develop a strategy, and to execute that strategy.

1. AGGRESIVE

- ENTRY – Accumulate shares at the lowest risk price of $140-$145.

- PROFIT – consider taking profit at Target 1: $155. If MACD Momentum crosses above the ‘Zero’ line at Target 1, that would be a ‘Buy Signal’ confirmation. and consider holding to Target 2: $160 while raising the STOP LOSS to $4 below the current price.

2. CONSERVATIVE

- ENTRY – Accumulate shares on a price move above a price of $145 with confirmation by the Technical indicators.

- PROFIT – consider taking profit at Target 1: $155. If MACD Momentum crosses above the ‘Zero’ line at Target 1, that would be a ‘Buy Signal’ confirmation. and consider holding to Target 2: $160 while raising the STOP LOSS to $3 below the previous days closing price.

| STRATEGY | ENTRY | STOP LOSS | TARGET 1 |

| AGGRESSIVE | $140-145 | $138 | $155 |

| CONSERVATIVE | $145 | $138 | $155 |

4. MANAGE RISK

The Fourth Secret to a Successful Trade is to manage risk.

STOP LOSS – $138 represents a $2/share loss. If the stock price drops below $138 there is no secondary technical support level. Look to re-enter the trade if the stock recovers and makes a subsequent move above either $140 or $145 using the stated LONG Strategy and Execution – Aggressive or Conservative. As price moves up towards Target 1 and Target 2 consider raising the Stop Loss to $4 below the days closing price.

POSITION SIZE – using a STOP LOSS of $138 represents a $2/share downside risk. As a general rule of thumb, consider dividing the total risk you are will to accept by $2 to determine the number of shares to build into this position.

5. REPEAT SUCCESSIVE TRADES

The Fifth Secret to a Successful Trade is putting together a string of profitable trades. Compounding is the most powerful force in any investment

Price will enter and establish a new trading range either between $145 and $155. If a range is established consider multiple trades within this range. OR if price moves above Target 1, there will be a longer term Trend Change signalling higher prices to Target 2.

what does that mean at stockmarketHQ

The Long Strategy is supported by technical indicators that are strengthening under the surface while price remains within the $140-$144 range.

The November/December stock price decline appears to be a function of

- Seasonal end of year tax Loss Selling in which Institutions sell losers to offset capital gains in other stocks.

- United Nations COP28 Climate Summit Nov 30-Dec12 in which approximately 80 countries are advocating for a commitment to the end of fossil fuel use.

It is important to understand the risks to this Fast Trade

- OIL PRICES – CVX stock price closely tracks oil. If price drops below $70 or does not climb above $80 then the trade will not materialize and should be exited.

- RECESSION – generally oil prices drop during a recession. If sentiment shifts towards increased possibility of recession, CVX’s stock price may be affected.

- DON’T FIGHT THE TREND – the current trend in oil stock prices is downward. Trading against the trend involves high risk. It is important to follow a strategy. Take profits at Targets and maintain STOP LOSS sell orders to minimize risk.

- TAX LOSS SELLING – if this increases, the stock price may decline below $138.

Following the stockmarketHQ Five Secrets to a Successful Trade targets a 90% probability of a successful trade while minimising risk. From a Technical Support price of $140, the Long strategy provides a 90% probability of catching the trade in the direction of the breakout from the Volatility Squeeze with the potential to provide a 5-15% profit while limiting downside risk to approximately 2%.

DISCLAIMER – all information is provided for educational purposes only, with no guarantee of the outcome. No investment should be made based on any ideas or opinions of the author. No investment decision should be made without first conducting your own due diligence and research including but not limited to company prospectus, all public filings by the issuer of the security, security charts and all other publicly available information. Information on trade ideas and opinions may or may not be updated on a regular basis and the author assumes no responsibility to do so.