The full Investment Thesis Thesis for Disney can be found at

DISNEY INVESTMENT THESIS (click here)

RISKS

There are Risks to this Trade Thesis

ANALYST DOWNGRADE – 29/6/2023 Keybanc downgrade citing 5 reasons – 1. Stalled DTC Subscriber growth 2. Failure to differentiate DTC churn 3. sagging Disney content sales 4. ‘materially harder reality of moving ESPN to streaming 5. Parks expectation in US and global remain too high.

These ‘Reasons’ reflect the broader concerns within the analyst community and have been Threats/weakness for an extended period.In Theory these concerns should currently be reflected in the stock price, however there is always the chance that they may accelerate/materialise further as a catalyst for additional analyst downgrades.

MARKET STRENGTH – Broader market is currently near an intermediate term ‘overbought condition’ with investor sentiment reflecting greed/complacency, most notably as a result of the Big 5 Tech companies. A pullback in the the Big 5 may result in a broader market decline affecting all stocks or may result in a rotation out of the tech sector into other sectors.

EARNINGS SEASON – Disney is expected to announce earnings between August 8-12. Earnings Season begins July 12 with the Financials which will bring a period of high volatility within the market.

INTEREST RATE POLICY – US Federal Reserve meets July 25/26. US Monetary policy is the biggest driver of stock market movement.

FLORIDA GOVERNMENT DISPUTE – Disney has been in a political/legal dispute with Florida Governor/ Presidential candidate De Santis over the jurisdiction of the Disney World Resort lands.

WRITERS STRIKE – The Writers union is in a strike position which affects content creation and production. However, it must be remembered that a deal is always reached and all union negotiations come to an end which would be a catalyst to the share price.

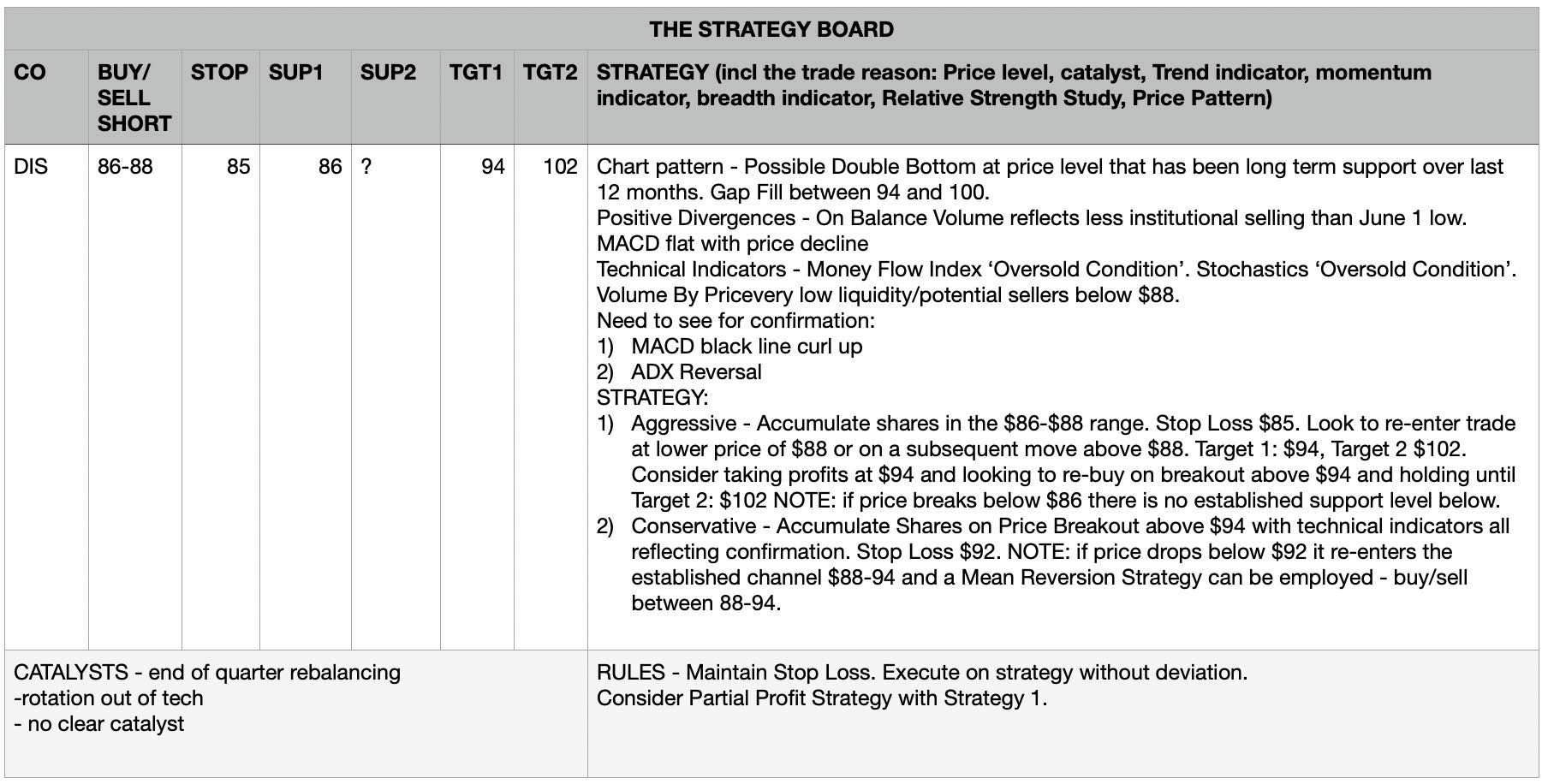

TRADE THESIS

| DISNEY TECHNICAL ANALYSIS |

|

|