Break a bone, go for an X-ray. Mold in the lungs, go for an x-ray. Joint pain, go for an x-ray. X-Ray machines are arguably the most commonly used, and most taken for granted, medical diagnostic tools by the general public. Those x-ray machines, developed in 1896, were one of the earliest General Electric products that fostered the growth of GE Healthcare into a company with over four million installed devices across its four business segments – Imaging, Ultrasound, Patient Care Solutions, and Pharmaceutical Diagnostics.

There are Five Secrets to a Successful Trade

- Choose the Right Stock

- 90% Probability factor

- Strategy and Execution

- Manage Risk

- Repeat Successive Trades

1. Choose the right stock

The First Secret to a Successful Trade is to choose the right stock.

The first step to choosing the right stock for a trade is to ask yourself a simple question, “What are is the reason that Big Money Managers would put millions of dollars into this stock?” This forms the ‘INVESTMENT THESIS’.

THE FULL GE HEALTHCARE INVESTMENT THESIS CAN BE FOUND HERE (CLICK)

At stockmarketHQ, we start with a very simple framework

- Best in Class Company

- Secular Growth Trend

- Strong Macroeconomic Environment

Choosing a ‘trading stock’ with a strong ‘Investment Thesis’ provides the stability and predictability that only big financial institutions can provide.

The second step to choosing the right stock for a trade is to ask yourself the question, “What is the reason that Big Money Managers will buy the stock ‘right here, right now’”?

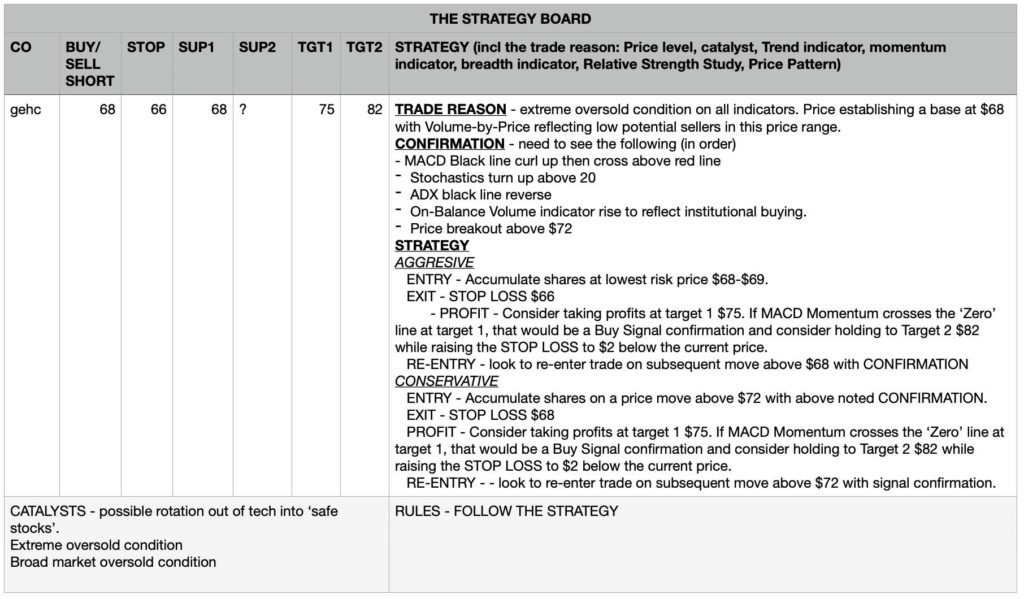

TRADE REASON – The Technical Analysis trade set up reflects the stock has been in an extreme ‘Oversold Condition’ on all technical indicators. Price is establishing a base at $68 with Volume By Price reflecting low potential sellers at this level.

2. The 90% Probability Factor

The Second Secret to a Successful Trade is to buy the right stock, at the right time.

At stockmarketHQ we try to target a 90% probability of success by using Technical Analysis to see what the Big Money Managers have done and understanding what they will have to do going forward.

- Money Flow Index (20 is ‘Oversold’, 80 is ‘Overbought) – currently at 17 the stock has been in an ‘Oversold’ condition for 2 weeks.

- MACD Momentum indicator Black Ione has started to turn up as a first buy signal indication.

- On Balance Volume reflects the lowest level of institutional ownership in six months.

- Volume-by-Price reflects very few potential sellers the $68 price level.

- Price is establishing a base at $68.

- ADX black line is at an extreme, rolling over and turning down would be a confirmation of the trend change from downtrend to uptrend.

- Stochastics indicator turning up, a cross above the 20 level would be a trend reversal signal.

SEE TECHNICAL ANALYSIS CHART BELOW

The combination of all the technical indicators reflect an oversold condition with very few potential institutional or retail sellers remaining.

3. Strategy and Execution

The hardest part of trading is overcoming the two most powerful emotions of ‘Fear’ and ‘Greed’. Warren Buffett famously stated, “be fearful when others are greedy, and greedy when others are fearful.” The problem is, when it comes time to buy, you won’t want to. When it comes time to sell, you won’t want to.

The Third Secret to a Successful Trade is to develop a strategy, and to execute that strategy.

1. AGGRESIVE

- ENTRY – Accumulate shares at the lowest risk price of $68-$69.

- PROFIT – consider taking profit at Target 1: $75. If MACD Momentum crosses above the ‘Zero’ line at Target 1, that would be a ‘Buy Signal’ confirmation. and consider holding to Target 2: $82 while raising the STOP LOSS to $2 below the current price.

2. CONSERVATIVE

- ENTRY – Accumulate shares on a price move above $72 with confirmation by the Technical indicators.

- PROFIT – consider taking profit at Target 1: $75. If MACD Momentum crosses above the ‘Zero’ line at Target 1, that would be a ‘Buy Signal’ confirmation. and consider holding to Target 2: $82 while raising the STOP LOSS to $2 below the current price.

4. Manage Risk

The Fourth Secret to a Successful Trade is to manage risk.

STOP LOSS – $66 represents a $2/share loss. If the stock price drops below $66 there is no secondary technical support level. Look to re-enter the trade if the stock recovers and makes a subsequent move above either $68 or $72 using the stated Strategy and Execution – Aggressive or Conservative. As price moves up towards Target 1 and Target 2 consider raising the Stop Loss to $2 below the days closing price.

POSITION SIZE – using a STOP LOSS of $66 represents a $2/share downside risk. AS a general rule of thumb, consider dividing the total risk you are will to accept by $2 to determine the number of shares to build into this position.

5. Repeat Successive Trades

Compounding is the most powerful force in any investment

The Fifth Secret to a Successful Trade is putting together a string of profitable trades.

Price will enter and establish a new trading range either between $68 and $75, or if price moves above Target 1, between $75 and $82. Consider taking profits on multiple trades of 5-8% within this this range.

what does that mean at stockmarketHQ

Statistically, even the best traders have a 30-35% success rate.

Following the stockmarketHQ Five Secrets to a Successful Trade targets a 90% probability of a successful trade while minimising risk.

The GE Healthcare Fast Trade strategy has the potential to provide an 8-18% profit while limiting downside risk to approximately 3%.

THE STRATEGY BOARD

DISCLAIMER – all information is provided for educational purposes only, with no guarantee of the outcome. No investment should be made based on any ideas or opinions of the author. No investment decision should be made without first conducting your own due diligence and research including but not limited to company prospectus, all public filings by the issuer of the security, security charts and all other publicly available information. Information on trade ideas and opinions may or may not be updated on a regular basis and the author assumes no responsibility to do so.