Every trade has to be supported by an underlying Investment Thesis, or reason, why the big financial institutions would hold a company in its portfolio. That Investment Thesis provides the foundation on which a Fast Trade can be made when there is a dislocation between the stock price and the intrinsic value of the company.

CHOOSING THE RIGHT STOCK

When considering an investment in any company, the Investment Thesis has to be considered within the context of three areas.

Best in Class – Over the last 135 years, JNJ has grown to become the worlds most diverse and largest healthcare firm. The company is projected to earn approximately $10.50 per share in 2023 and Revenue between $97-$100 Billion with annual growth expected to be approximately 6%. The company provides a $4.52/share dividend (3% as of March/23) and in Sept 2022 the company announced a $5B share repurchase program. JNJ is one of only two companies assigned the highest possible S&P Credit rating of AAA reflecting the strongest confidence that the company will be able to service and repay its debt.

Secular Growth Trend – is a change in the way society behaves. Generally this is viewed in the light of mobile phones, internet streaming, electrification and artificial intelligence. JNJ’s secular trend exposure can considered within the context of a globally growing population, and possibly more important, an aging population, both of which will require increasing health care needs.

Strong Macroeconomic Environment – As of March 2023 the US economy is strong, causing the US Federal Reserve to increase interest rates. Many analysts view the interest rate policy as a deliberate move to force the economy into a recession. If a recession materializes, big money managers would generally rotate into defensive sectors.

INVESTMENT THESIS

The Investment Thesis is founded on 3 pillars

- Defensive component in a diversified portfolio, dividend and share buyback program

- Growing and aging population’s healthcare requirements

- Healthcare spend – is a percentage of National Gross Domestic Product (GDP).

TRADE THESIS

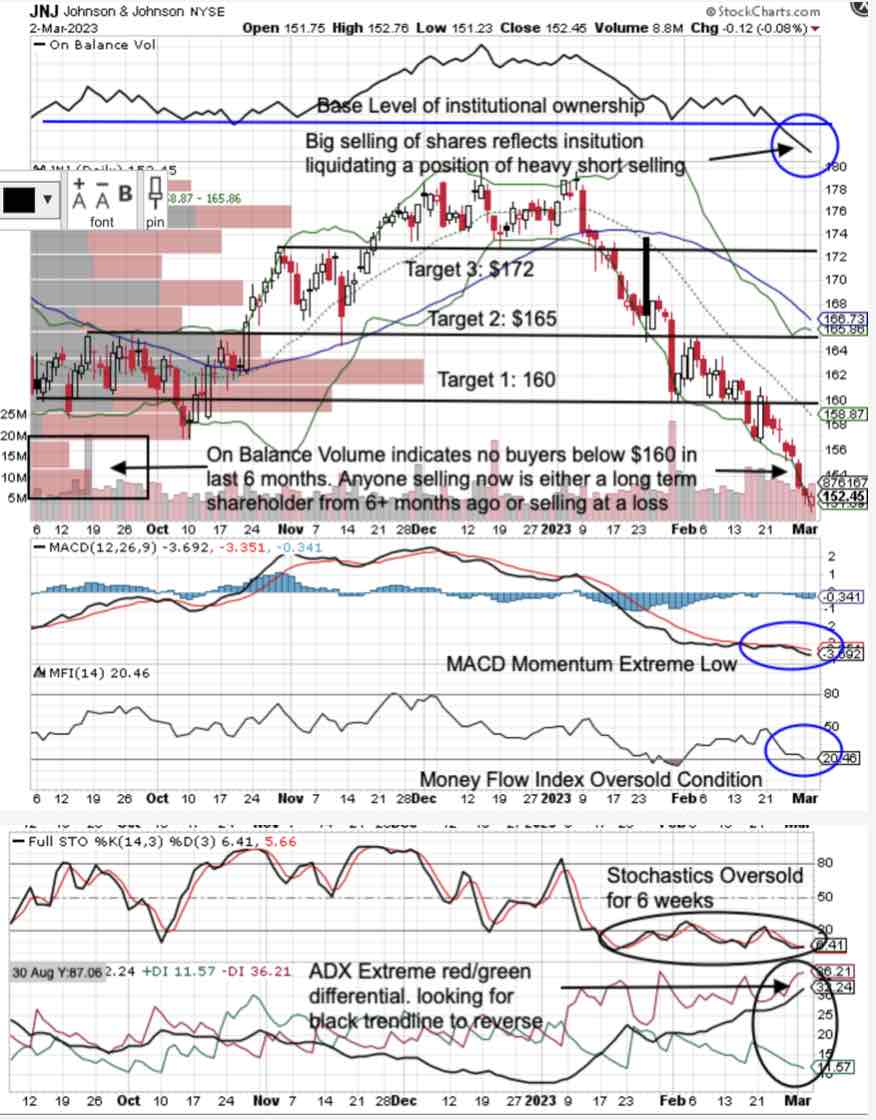

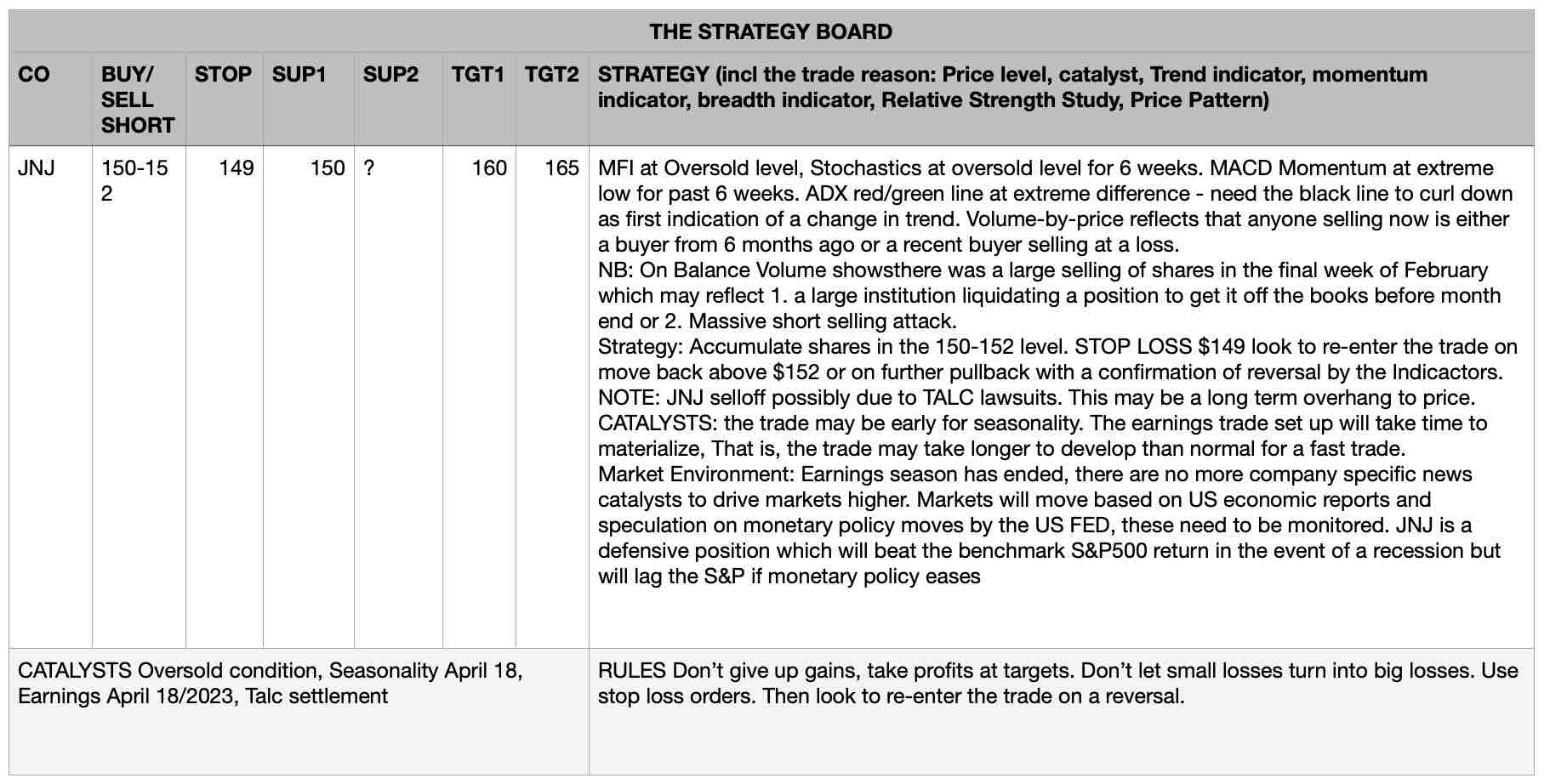

- Technical Analysis – reflects an oversold condition in which any remaining sellers are either selling at a loss or have been shareholders for over 6 months.

- Economic Reports on inflation, monetary policy decisions and possibility of recession may cause Big Money Managers to rotate into ‘Defensive’ positions.

RISKS TO THE TRADE THESIS

- An oversold stock can get more oversold if institutions start liquidating positions.

- DON’T FIGHT THE TREND – the price trend has been down for two months. Trading against the trend involves high risk.

- Talc lawsuit related headlines may have been the catalyst driving price down, further headlines will negatively affect stock price.

- Economic reports that negate the possibility of a recession will cause Big Money Managers to rotate out of ‘Defensive’ stocks into tech and cyclicals.

TECHNICAL ANALSYSIS

|

|