- JPMorgan kicks off earnings season April 12

- MONEYWISEHQ Market Updates have highlighted the need for financials to advance in order for the market trend to continue.

- Our Earnings Season Strategy has this set up as a Pattern 2 with a low risk entry and significant upside.

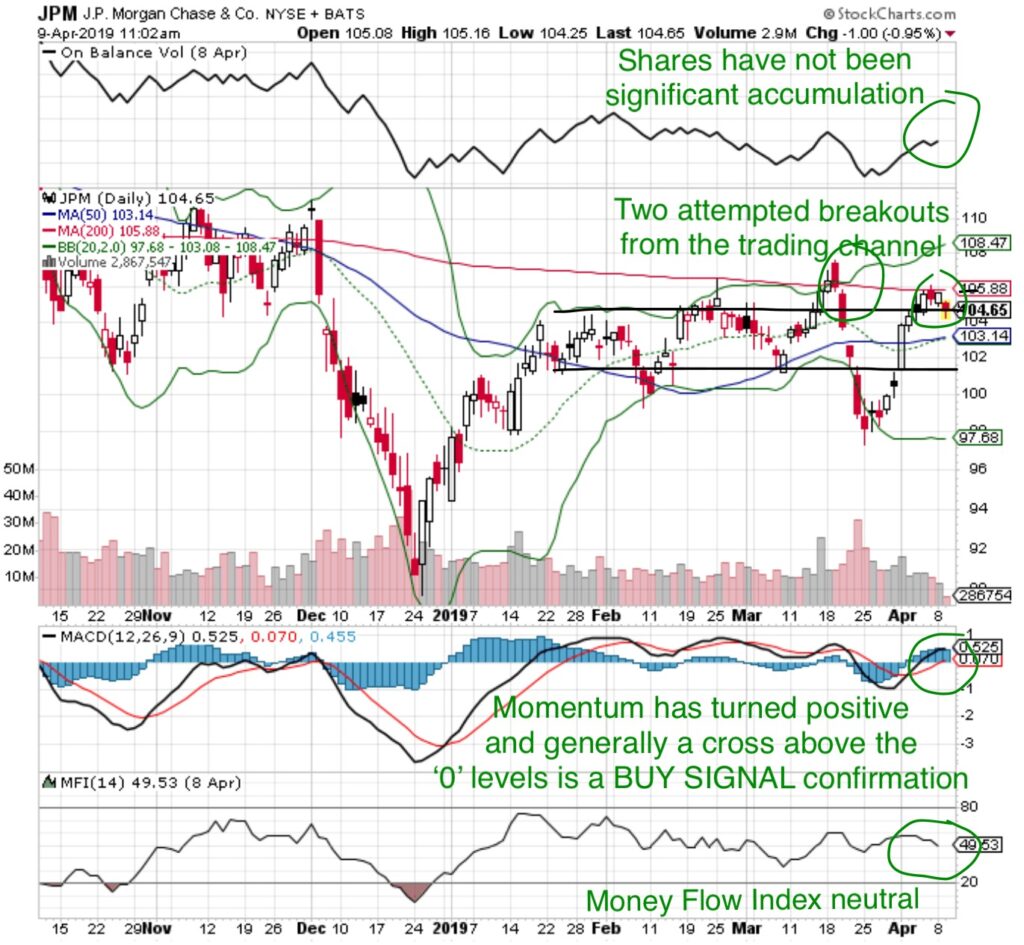

Money Flow Index (80 is Overbought, 20 is Oversold): 49 is a neutral level.

MACD Momentum: has turned positive. Generally a cross above the ‘Zero’ line is considered a BUY SIGNAL confirmation.

On Balance Volume (OBV indicates share accumulation/distribution): Shares have not been under any committed accumulation by institutions since the December crash.

Stock price: has remained within a rough channel between $101 and $105. There have been two attempted breakouts above this range which failed. This reflects that there is buying interest at low risk levels but Big Money Managers are not willing to commit capital to speculation beyond that.

What does that mean at MONEYWISEHQ

We are going to focus on the earnings season ‘catalyst based’ trade setup.

During Earnings Season stock prices follow one of three patterns

- Stocks run up in anticipation of strong results, then selloff when earnings don’t meet high expectations.

- Stocks remain neutral until the release then either move up or down based on the actual results

- Stocks decline as a selloff due to uncertainty of the results, then climb when results are not as bad as expected.

Neutral Money Flow Index, low On Balance Volume accumulation, price within the long term trading range and MACD Momentum crossing above the ‘Zero’ line is a Pattern 2 setup.

Downside risk is well defined near $101, upside reward could be towards $110 then $117.

Earnings Report Risks

Banks make money off high interest rates. The recent pullback in the 10 Year Bond Yield to near 2.45% will affect profitability. Commentary on the US Federal Reserve maintaining or even cutting interest rates will impact bank stocks.

Interest rate risks may be counterbalanced by

- a strong consumer who is increasing spending and with strong employment numbers increasing deposits

- Strong business activity revenue generation

- strong Macroeconomic environment

- Low interest rates stimulating higher volume mortgage and personal lending

- Initial Public Offering’s (IPO’s) and Merger and Acquisition brokering

The interest rate risk has been well known since January, so the possibility of that negative catalyst should already be considered within the stock. The potential for better than expected results from the counterbalancing forces offers the opportunity for upside reward.

STRATEGY

An entry near $101 – $104 is the lowest risk position and allows for a tight ‘Stop Loss’ Sell price near $100.