This weeks headlines

- US Federal Reserve Meeting – expected to announce financial tapering plan Wednesday

- WHO announces Omicron more contagious than any previous variant

Market Dynamics

In the Market Update 5/12/21 we discussed the uncertainty caused by Omicron and the US Federal Reserve ‘End of Free Money’ financial tapering and we want to continue to monitor these two in order to asses if they will advance from an ‘uncertainty’ to a ‘threat’. Recall we progress economic issues through three stages,

1. Uncertainty

2. Threat

3. Event

Omicron – Travel and leisure stocks within the ‘Re-opening Trade’ Thesis remain under pressure on news of a Omicron related death in the UK and a WHO announcement that the virus spreads faster than previous variants.

Tapering and Interest Rate Increases

On Wednesday the US Federal Reserve is expected to announce its bond purchase tapering and interest rate plan. The timeframe of these changes and the magnitude will determine how Big Money Managers reposition, and how fast they do it.

Santa Clause Rally

The Santa Clause rally is a seasonal phenomenon that occurs over the last five trading days of December and the first two trading days of January. The past 34 of 45 Christmas’s have provided positive returns during this period. There are a number of reasons attributed to the rally

- End of ‘tax loss’ selling and portfolio repositioning (selling losers)

- Big Money Managers (particularly bears) on vacation

- General sense of happiness by investors

At the moment there is an expectation for a Santa Clause Rally. Sometimes that expectation can become self fulfilling or can be a setup for money managers who are trapped in positions, to sell into strength.

TECHNICAL ANALYSIS

Volatility index (Fear Gauge)

Note the decline in ‘Fear’ from the extreme levels of the previous week.

The CNN Fear and Greed index has changed from the extreme level of 20 to 38. This change reflects ‘caution’ when coming off a low. Big money managers are not willing to commit new capital to the markets.

Mcclellan Oscillator

This is a good example of a ‘bounce’ from an ‘Oversold’ market which lead to the market touching the previous high. Generally these ‘extreme oversold’ conditions are the lowest risk entry points for a trade.

Whenever there is an ‘extreme’ condition, either Overbought or Oversold, the market resets itself and a new pattern will develop.

S&P500

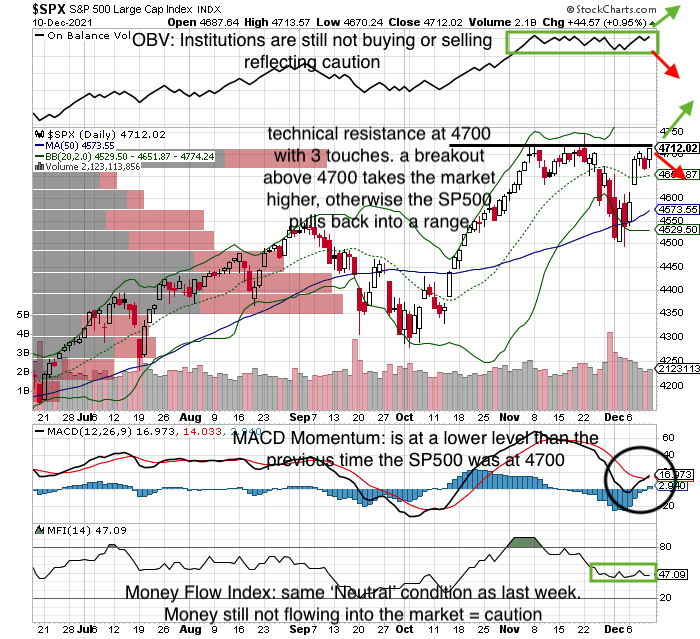

On Balance Volume (OBV): remains within a tight range. institutions are still not buying or selling. This reflects ‘caution’.

Money Flow Index: remains in the same ‘neutral’ position as the previous week. Institutions are still not putting money into the market.

MACD Momentum: is at a lower level than the previous time the S&P500 was at 4700.

Technical Resistance: the 4700 level has been touched three times in the past four weeks reflecting that Big Money Managers are not willing to commit to the market. Uncertainty.

What does that mean at moneywiseHQ

Big Money Managers are the ones who move markets. They move tens and hundreds of millions of dollars of capital through the market. They borrow money to make more money and then leverage that to make even more money.

To do that they need ‘certainty.’ and Big Money Managers like certainty. The entirety of the financial industries marketing is founded on financial security. Until there is a resolution to the questions surrounding Omicron and the End if Free Money, headlines will move stocks.

As small investors we watch what the Big Money Managers are doing through the technical indicators and those indicators are reflecting caution.

Caution = uncertainty discount

Uncertainty Discount = opportunity

There is a battle on Wall Street between Uncertainty and the potential for a Santa Clause Rally. Opportunity always has to be viewed within a strategy of risk management. If you don’t protect your money, somebody is going to take it from you.