NETFLIX (NFLX) TECHNICAL ANALYSIS 12/1/19

- Netflix reports earnings January 17

- Shares have risen steeply on two catalysts

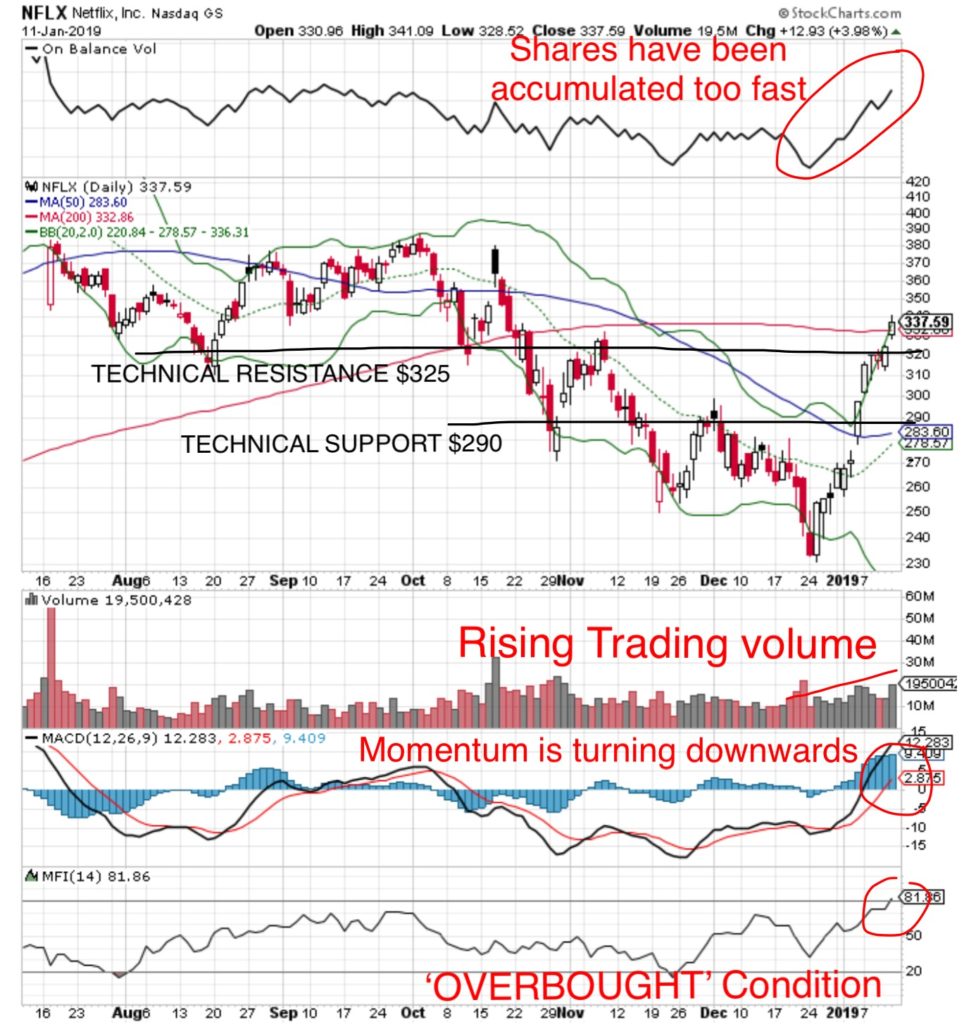

- Technical indicators reflect an ‘Overbought’ condition.

Money Flow Index (20 is ‘Oversold’, 80 is ‘Overbought’): at 81 NFLX is ‘Overbought’.

MACD Momentum: is near a peak and is in the first stages of turning downwards.

Trading Volume: has been rising as prices have risen this is possibly reflective of a ‘short setup’.

On Balance Volume (accumulation/distribution): shares have been accumulated very fast.

Technical Resistance: at $325 there should have been some selling pressure, however shares broke out above this level. Theoretically on a breakout, shares should continue higher, however often a ‘false breakout’ will rise above resistance before falling back.

Downside Risk: established at Technical Support near $290.

What does that mean at MONEYWISEHQ

Netflix reports earnings January 17.

Stock price movement leading up to Earnings reports follows one of three patterns

- Stocks run up in anticipation of strong results, then selloff when earnings don’t meet high expectations.

- Stocks remain neutral until the release then either move up or down based on the actual results

- Stocks decline as a selloff due to uncertainty of the results, then climb when results are not as bad as expected.

The stock price action is reflective of pattern 1.

There were two catalysts that drove the stock price up.

- Release of the Netflix Original movie ‘Bird Box’ which had a viewership of 45 million accounts in it’s first week. Compare that with aqua man which sold 13 million tickets.

- Golden Globe Awards in which Netflix won a number of awards

Once a catalyst is past, there is often a reversal.

Netflix is is a bit tricky, the stock price is still 20% off of it’s highs which means there is room to a full recovery, however the technical indicators reflect a massive amount of money has flowed into the stock between $240-$320 providing a near 40% profit for buyers and in a volatile market those profits will likely be locked in. This also looks like a setup for a large short movement.

Strategy: consider locking in profits on in partial positions and maintain a disciplined Stop Loss near $335. If the stock drops below $330 the next level of support is near $290.