INVESTMENT THESIS

The Investment Thesis for facebook is founded on three pillars

- Active Users – Facebook has 1.7 Billion daily Active Users (DAU’s) and over 2.6 Billion Monthly Active Users (MAU’s) across the globe.

- Advertising Platform and Machine Learning – facebook is an advertising platform which uses artificial intelligence to target ads to the individual user for the highest possibility of of a conversion to a sale. Average Revenue Per User (ARPU) in the First Quarter 2020 was $34.18 in the USA and Canada and $6.95 globally.

- Additional Platforms – Whatsapp, Instagram and messenger provide platforms for future monetization through advertising. April 27, 2020 Facebook announced two additional services, Messenger Rooms to compete in the Video Conferencing space with Zoom. May 19, 2020 Facebook announced ‘Shops’ which allows small to medium sized businesses who had limited website or internet exposure to quickly create a ‘storefront’ within the facebook ecosystem.

This is a vertically integrated Investment Thesis. Facebook makes its money through advertising. The platform uses an ‘auction’ system on which advertisers bid against each other for advertising space on

While facebook is highly monetized, the additional platforms of WhatsApp, Instagram, Messenger, Messenger Rooms and Shops each act to

- draw additional users into the ecosystem,

- increase the amount of time or exposure existing users spend in the ecosystem

- provide future ‘advertising’ space which facebook can monetise.

Marketing 101

- Companies must advertise to create both a ‘need’ and a ‘want’ to generate consumer demand. In

theory this becomes more important during weak economic times. - It costs more to regain a lost customer than it does to maintain an existing and loyal customer base.

- In competitive markets, companies

which don’t advertise risk losing market share. Markets become more competitive during weak economic periods.

There are three risks to the stock price

- Lower advertising prices – prices are based on an ‘auction system’ where advertisers bid on page views. Advertisers may be reducing advertising

volume, or reducing budgets, which lowers prices. - Politics – There are lingering issues over privacy and regulation.

- Increased costs – In order to mitigate government restrictions and ensure the ‘health’ of the platforms,

facebook has been investing heavily in hiring, artificial intelligenceand minimising false information and accounts.

The following video highlights

TECHNICAL ANALYSIS

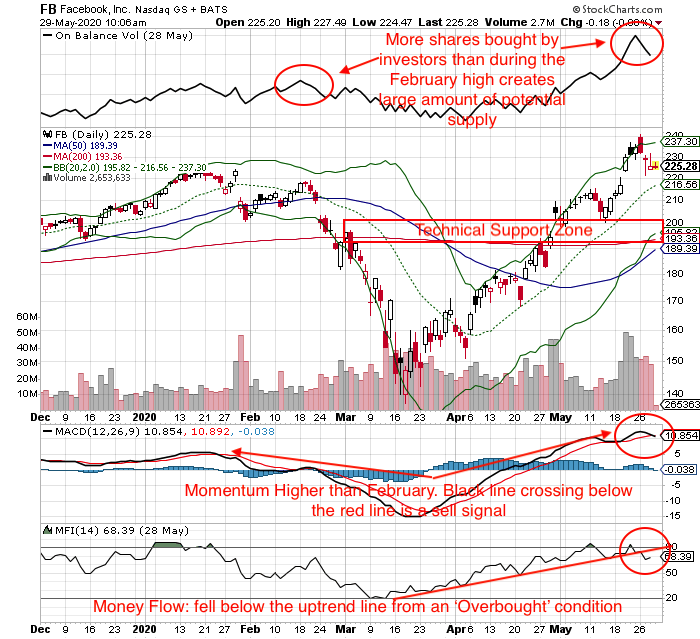

On Balance Volume (OBV) (reflects Large Financial Institution accumulation or selling of shares): More shares have been accumulated by Large Financial Institutions during the Covid-19 pandemic than during the February market peak. This is a concern because it provides a significant ‘supply’ in the event of a broader market pullback which can quickly accelerate a price decline.

Money Flow Index (80 is ‘Overbought’ 20 is ‘Oversold’): Current 68. A two month uptrend line of money flow into the stock has been broken after reaching an ‘Overbought’ level above 80. This would generally be an indication of a reversal in the stock price.

MACD Momentum: The black line has curled downwards which confirms the first indication of a potential price reversal. The Black line crossing below the Red Line would be a ‘Sell Signal’.

Technical Support (Downside Risk): $200 – $190. This is a rough ‘Zone’ because of the rapid acceleration and ‘Gaps’ in the stock price as it moved up.

Technical Resistance (Upside Reward): $240

What does that mean at moneywiseHQ

Facebook has an extremely powerful Investment Thesis in an industry which is effectively a duopoly with Google and which has high barriers to entry.

When choosing a stock at moneywiseHQ, there are three important criteria

- Best in Class

- Secular Growth Trend

- Strong Macroeconomic Environment

Facebook has used its first mover advantage in social media and the scale and scope of global exposure to create its own secular growth trends and the platforms by which society stays connected.

Consider a fourth criteria

4. Exponential Growth – While the total number of Monthly Active Users may be reaching saturation levels near 2.6 billion on the

Stock price is a function of supply and demand. A stocks price will go up if Institutions start buying or sellers stop selling. A stocks price will go down if Institutions start selling.

With the number of shares bought by institutions during the Covid-19 pandemic being far higher than the February market

The downside risk is $200, the upside reward is $240, however, it is important to consider this starting from an ‘Overbought’ condition.

At

moneywiseHQ Strategy

- Maintain a trailing STOP LOSS on existing holdings in the event of a broader market pullback or institutional profit-taking in the stock.

- Buy on a pullback to $200. Maintain a disciplined STOP LOSS at $198 and re-evaluate for

a re-entry to the trade. If the stock price drops below $198 it may fall to $190 where a trade re-entry can be considered.

A good investor has to be aggressive to make money, but if you are not defensive you won’t keep your money.